Why ESG investments are here to stay

Year 2017. As many as 97 polluting industries near Bellandur Lake, located in the sleepy terrains of south Bengaluru, receive government orders for closure.

Year 2018. The government asks a copper factory in Tamil Nadu’s Thoothukudi city, known for cultivation of pearl fishes, to wind up operations. Residents claim smelting has led to effluents and sewage, thereby polluting the city.

Rummage through the pages of India’s industrial history. These aren’t the only instances of the Indian government clamping down on projects detrimental to the environment. Even across the globe, there’s a conscious effort to monitor businesses that become ecological parasites.

It’s not just officials in ministerial positions who’re cognisant of companies’ actions. Investors too believe they can contribute to a better world by allocating their capital to organisations that value ethical factors over short-term profits.

Their concerns aren’t limited to earth’s environmental health alone. They seek investment opportunities with organisations that give credence to social issues too such as poverty, hunger, or unstable healthcare systems. It must be emphasised here that stakeholders aren’t indifferent to aspects of governance either. They align with companies that have a humane approach towards their employees and cultivate an inclusive and diverse environment among the workforce. They’re curious to know every details of the board, its C-level executive strategies, and whether the company has a history of unprincipled activities.

The heartening aspect is that even corporates are convinced that businesses can’t be judged by financials alone. In anchoring sustainability firmly in all areas of business activities, organisations too are demonstrating keenness to adapt to future realities. First, let’s switch to investors.

What is ESG investment?

Through the last decade, the concept of ethical investment has permeated into investors’ thinking. They’re only too willing to integrate Environmental, Social and Governance factors, known by the popular acronym ESG, into their investments without trading off on profits.

They’ve faith that companies’ which focus on people, planet, and profits — the triple bottom line — will deliver risk-adjusted returns over the medium to long term. Their confidence isn’t misplaced. ESG isn’t an abstract idea; it’s very much measurable now.

SEBI’s new disclosure norm, the Business Responsibility and Sustainability Report, is expected to provide quantifiable ESG data. Investors can measure risks across organisations, sectors and time. In fact, according to a recent study, 93% of the world’s top ESG-focused companies have been disclosing details such as consumption of water, recycling of plastic and so on.

Is ESG a good investment? Why should one go for it?

It could be said that ESG is a rare financial instrument that consistently rewards both the business and the investor. Such schemes don’t fit into a short-sighted quest for overnight wealth. Profit here is a by-product of years of ESG discipline. Add to that the greater resilience that ESG investments exhibit to cope with market volatility.

That ESG is a sound investment option isn’t even a debate. A study by Harvard Business School over a 20-year period claims that organisations that delivered on material sustainability factors – it means having a limited impact on natural resources – outperformed those that did poorly on both stock returns and corporate profits.

But ESG investments aren’t only about glittering track records stemming from resource-efficient processes. As established earlier in this piece, organisations that demonstrate a spirit of service, care for societal changes and don’t measure success on excel spreadsheets end up being sustainable too. Such attributes not only create brand loyalty but also contribute to the inherent sustainability of the company. ESG has inherently based on the premise that noble deeds get the luscious fruits sooner than later. Companies adhering to ESG principles sell their stories globally and build customer patronage.

That said, an informed investor needs to have a dispassionate view of ESG-efficient companies. As the adage goes: monitor your funds wherever they’re. The importance of having a sound ESG strategy can’t be undermined.

What is a good ESG investing strategy?

Essentially, an ESG investing strategy means recognising the opportunities and risks of a business to create a long-term sustainable value. It’s about identifying the company’s ESG approaches, vulnerabilities, value-creation plan, and steps to mitigate risks.

The investor knows whether the organisation is implementing its plans within a structured management framework. Not just that, the investor can measure actual results against what had been projected.

In financial parlance, a convincing ESG strategy positively impacts the Return on Investment (ROI), reduces lending and revenue risks. And now, the most significant step awaits investors. How do investors get started?

How to make an ESG investment

Being a responsible investor entails time and effort. It’s here that asset managers come into play. With their trained faculties, they identify the best-in-class ESG stocks through inclusionary screening. They select companies that are improving ESG measures more rapidly than their peers. An organisation’s inner culture and actions are considered rather than merely the product.

In the same vein, they use negative screening to filter out stocks that stray from sustainability principles. Industries such as coal, chemical and cement are viewed with a certain degree of scepticism owing to the negative attributes like global warming and carbon emissions associated with them.

That said, inclusionary and exclusionary approaches can vary depending on the preferences of the investor.

‘Sin stocks’ are usually weeded out. This term is often used to categorise shares of companies engaged in unethical businesses such as liquor, tobacco and gambling.

What kind of risks are encountered while investing in unethical companies?

Investors usually sidestep such stocks even though they could be high performers. A tobacco giant headquartered in West Bengal remains one of the most profitable FMCG firms. But in India, tobacco isn’t quite perceived as an enduring business model. There’s a growing clamour to implement anti-smoking laws, especially in public places.

Four years ago, French insurer AXA Group exited tobacco investments to set a precedence in ethical investing. Naturally, such stocks might not appeal to intelligent investors who want to mitigate risk.

So where’s the ESG future headed?

Why 2021 is the right time to invest in ESG funds

Market analysts believe 2021 should see breakthroughs in sustainability technology and a data-driven focus on ESG integration.

It’s widely held that ESG’s social element will be foregrounded, for the pandemic has exposed the inadequacies of our societal systems and limited access to healthcare.

Secondly, ESG-driven organisations are expected to integrate biodiversity in ESG analysis. Given the way encroaching on natural land is massively disturbing established ecosystems, demand could surge for forestry assets.

Meanwhile, demand is growing for greener and sustainable transport networks and buildings. The green bond is thus expected to get a lift. According to a report by the Climate Bond Initiative (CBI), green bonds touched a record high of $270 billion last year and has already reached $400-$500 billion in 2021.

All these factors point to a highly favourable ESG scenario this year. Is India ready to take the lead?

The signs are encouraging, going by India’s policy initiatives. India has fast-tracked the transition to BS-VI emission norms, the equivalent to euro-VI, skipping the BS-V stage.

With petrol prices surpassing the 100-rupee mark, electric vehicles have become the flavour of the season. Ola electric scooter has already registered 1 lakh reservations within the first 24 hours of opening bookings. Government subsidies are expected to further shore up the electronic vehicles sector and incentivise such sustainability initiatives.

Naturally, this rising ESG consciousness is bound to reflect on the investment scenario in India. The signs were encouraging even before the pandemic.

What are the ESG funds available in India?

According to market reports in January 2020, the Nifty 100 ESG had 88 companies spread across 16 sectors. Financial services, energy, consumer goods and IT accounted for 74 per cent of the index. It’s claimed that inflows into ESG mutual fund schemes had increased 76% in the financial year ended March 2021 at Rs 3,686 crore as opposed to Rs 2,094 crore in the same period last year.

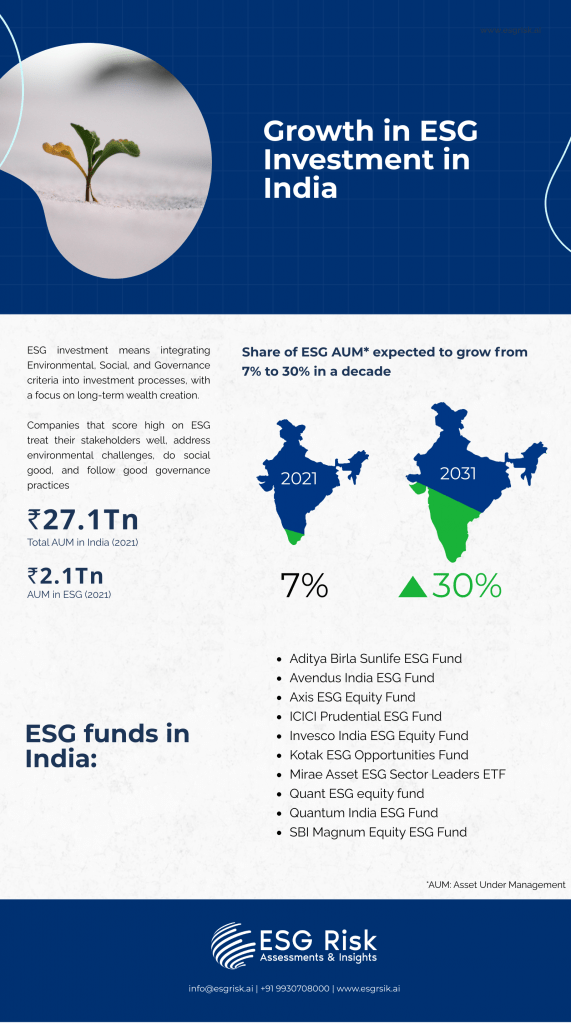

From a future perspective, India’s ESG-themed investments are estimated to increase to 30% by 2030, equal to over Rs 20,00,000 crore. It explains why sustainable investments have gained substantial traction in India, with several ESG funds (below) consolidating themselves.

Invesco India ESG Equity Fund

In this fast-evolving and competitive market, the role of ESG rating agencies becomes critical too.

Copy the following code to share this ESG infographic on your website

How ESGRisk.ai can help you select the right funds

Organisations like ESGRisk.ai, India’s first ESG Rating Agency, enable investors to directly integrate ESG factors into their portfolio construction and management.

Through transparent methodology tools, ESGRisk.ai help investors to know how a transaction or a project has impacted a company’s ESG rating. Transparency isn’t just about highlighting data, it’s also making stakeholders understand how scores are constructed.

In addition, these tools help companies benchmark their performance both domestically and globally against industry peers, providing them with an independent perspective on how they fare in the management of their ESG risks.