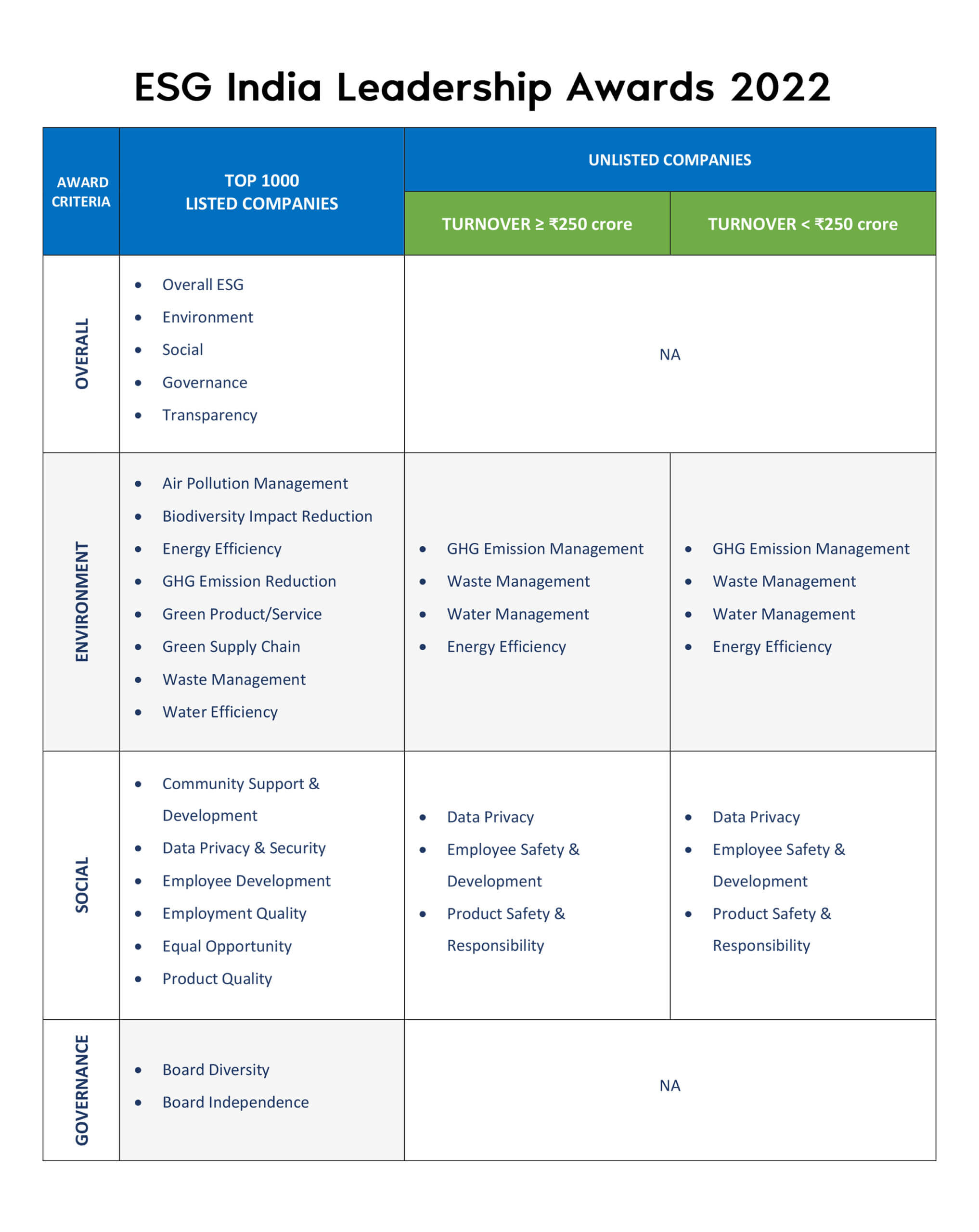

ESG Rating

A comprehensive ESG Rating requires identifying all material ESG risks & evaluating the company’s risk management practices to proactively address these risks. Since every company is exposed to a wide variety of risks & each impacts a company in varying degrees, the evaluation of exposure & scoring has to be done in a structured manner. There must be a hierarchy where individual indicators pertaining to the risk exposure & management can be aggregated to evaluate the performance.

We aggregate the data in three levels, viz: Key Issue, Theme & Category level; each of which is the next level of aggregation for hierarchical risk evaluation.

ESG RISK AI’s RATING APPROACH

ESGRisk.ai’s Rating model and report is designed to help investors quickly understand companies’ ESG risk susceptibility & risk management framework, enabling investors to directly integrate ESG factors into their portfolio construction and management.

Methodology

ESGRisk.ai covers a company’s ESG performance across three categories, 19 themes and 35 key issues. The scores are based on a comprehensive rating of 1000 indicators.

Components of Rating

Transparency scores

Unique to ESGRisk.ai, this score is based on the company’s disclosure of signals.

Overall Transparency

BRSR from FY 2022-23

Number of signal where performance can be ascertained through BRR disclosures / Total disclosures required under BRR

Based on the company’s disclosure of signals, ESGRisk.ai will compute and publish two transparency scores, one will score the level of overall disclosures and the second will score the BRR disclosures relevant largely in the Indian context.

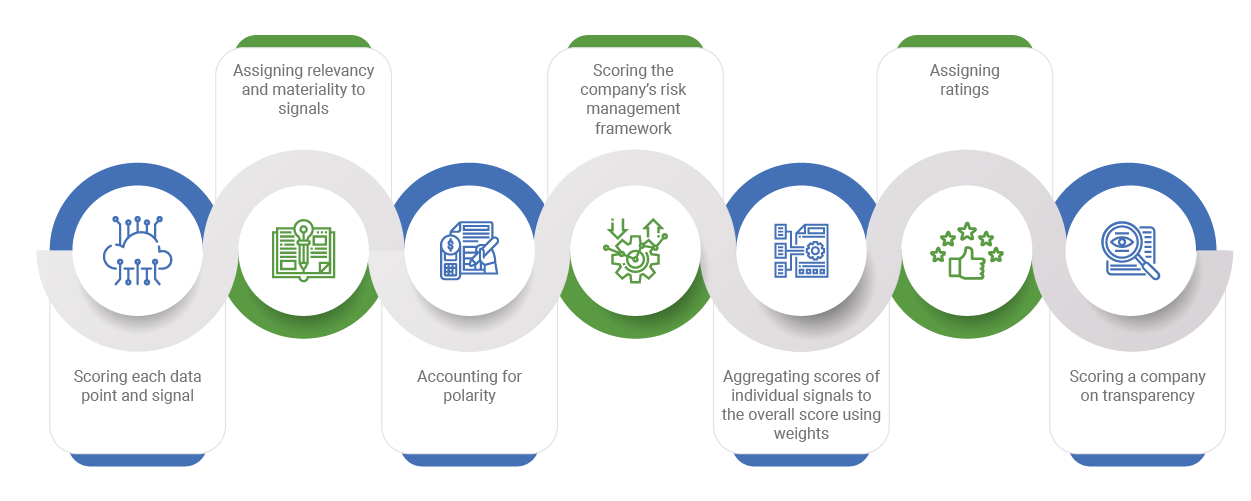

ESG HOW WE CONSTRUCT ESG RATINGS

Score

Each indicator and signal is scored based on the company’s issue specific performance .

Aggregate

Individual signals scores are aggregated using materiality and polarity.

Review

Analyst reviews and if needed changes the materiality of issues and weights.

Benchmark

Analysts then compare the company performance with its peers and the universe.

Rate

Success Stories

"At the onset we would like to thank you and your team for ensuring that KFin Technologies Ltd. went through a smooth journey towards our first ESG rating. Since this was our first journey towards ESG, we had to depend on your team to provide us with information, insights and guidance. We could not have completed this journey without your continuous support. Looking forward to more support in the future. Thank you."

KFin Technologies Limited"We have subscribed to ESGRisk.ai for monitoring the ESG performance of our investee companies. What we like the most about ESGRisk.ai is the extensive coverage, including many smaller companies, which is closer to our investment universe. The granular level ratings as well as scores help us evaluate our companies in detail. E, S and G scores are available separately, which help us interpret the attribution easily. We wish the team at ESGRisk.ai all the very best."

Nippon Life India Asset Management Limited"We thank you for the support rendered throughout the assessment process. We appreciate the methodology ESGRisk.ai adopted for the assessment process. The walkthrough sessions at the draft stage and the final stage were widely appreciated here at ESAF Bank. Looking forward to working with you on similar assignments."

"Vivriti is very delighted to have partnered with you, early on in our sustainability journey. The team is an exceptional group of open-minded & highly energetic individuals, who have been very flexible and responsive to meet our expectations. Their solutions are tailored and comprehensive which is highly evident from our ESG model that they have helped us design. It was indeed a great experience to work with the team."

Vivriti Capital Private Limited