India's first DEDicated

ESG Rating company

A SEBI Registered Category 1 ESG Rating Provider

ESG – An Enabler of responsible business

ESG stands for Environmental, Social & Governance practices that are referred to when measuring the sustainability & ethical impact of a company or investment on the larger community. Large number of investors, companies & regulatory bodies are integrating ESG aspects into their business strategies, assessment models & regulations with the objective to better manage & assess risks beyond “conventional” business & financial performance.

ESG Risk exposure & performance both affect companies’ short- &long-term financial performance & business viability. A company with a strong ESG track record can attract investments from long term institutional investors particularly pension funds. Such funds have a strong voice in the international demand for enhanced ESG disclosure.

Corporate sustainability starts with a company’s value system and a principles-based approach to doing business. This means operating in ways that, at a minimum, meet fundamental responsibilities in the areas of human rights, labour, environment and anti-corruption.

ESGRisk.ai is empanelled with AMFI as the ESG Rating Provider (ERP) to the Mutual Funds Industry in India

Corporate sustainability starts with a company’s value system and a principles-based approach to doing business. This means operating in ways that, at a minimum, meet fundamental responsibilities in the areas of human rights, labour, environment and anti-corruption.

ESG integration is the explicit and systematic inclusion of ESG issues in investment analysis and investment decisions. It is the analysis of all material factors in investment analysis and investment decisions, including environmental, social, and governance (ESG).

ESGRisk.ai is empanelled with AMFI as the ESG Rating Provider (ERP) to the Mutual Funds Industry in India

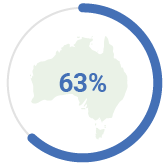

USD 40 TN invested in ESG focused investments globally

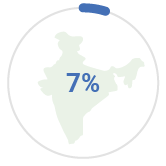

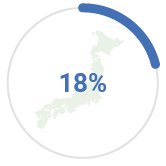

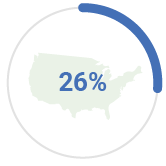

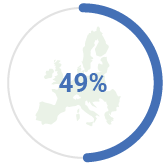

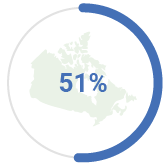

(% of AUM)

India’s ESG investment to increase to 30% by 2030

India

Japan

US

EU

Canada

Australia

With the changing global risk landscape, Indian businesses will have to discover new ways to reduce their environmental footprint and be more efficient and responsible with the use of water, energy and other natural resources. They will also have to integrate costs pertaining to their environmental impact into their product pricing as well as deal with the expectations of various stakeholders in terms of transparency, disclosures and business ethics.

These aspects, in absence of risk management and mitigation mechanism, will aggravate the credit risk for lenders and make returns from investment more uncertain. Simple ESG compliance may not be sufficient to improve companies’ profitability.

This is where an independent, unbiased, forward-looking and nuanced ESG rating system can help corporates with measuring their own performance and relative performance among their industry peers. It enables them in identifying weaknesses and opportunities and strengthening their competitive advantage. ESG rating has been accepted by the investor community as a very effective tool to identify companies aligned with their investment interests. Moreover, regulators, financial institutions, think tanks, etc. want to better understand & monitor companies & industries’ ESG performance & impact on sustainable development.

ESGRisk.ai’s rating is an objective, independent and unbiased opinion on a company’s ability to mitigate future/emerging risks associated with Environment, Social, and Governance issues that have material financial impact based on publicly available data. Our ESG ratings foster informed decision-making when it comes to e.g. choosing ESG investments, assessing a particular companies or industries performance, reviewing ESG business strategies and identifying need for policy interventions.

To actively contribute to and be aligned with the worldwide ESG movement and policy dialogue, we are signatories of various global frameworks. Being a member of the GRI community, ESGRisk.ai actively contributes to advancing sustainability reporting. Moreover, Acuité is the first credit rating agency from India to become a signatory of PRI’s ESG in Credit Risk and Ratings Statement in order to enhance the systematic and transparent consideration of financial material ESG factors in the assessment of creditworthiness.

Our Differentiators

Extensive Company Datasets Available for Validation

Comprehensive Risk Assessment

Model

Analyst

Expertise

Our analysts are trained specifically for ESG risk assessments and they compare the company scores with industry peers and the universe of companies under ESGRisk.ai’s coverage, to assess relative performance and assign the rating

Continuous

monitoring

Maintain the ratings by updating data with new disclosures, monitoring negative news and corporate events

BOARD OF DIRECTORS

Sankar Chakraborti

Non – Executive Chairman

Manish Kumar

Independent Director

Shailly Kedia

Independent Director

Pooja Ghosh

Chief Rating Officer

Reshma Polasa

Non-Executive Director

ESGRisk.ai (Subsidiary)

ESGRisk.ai draws upon Acuité Group’s experience in the Indian market accumulated over the last 15 years through ratings of 9500+ companies in bond rating scale and a total of 50,000+ SMEs. ESGRisk.ai is part of the Acuité Group company. The Acuité Group – established in 2005 – comprises of Acuité Ratings & Research, SMERA Ratings Private Limited and ESGRisk.ai. Acuité Ratings & Research is a reputed SEBI registered and RBI accredited rating agency specializing in bank loan and bond ratings. SMERA, approved and incorporated by the Ministry of MSME and Government of India, is a pioneer in providing rating and grading services to SME in India. Acuité Group’s major shareholders are SIDBI, Dun & Bradstreet, ICICI Bank, SBI and other leading Indian public sector banks.