Frequently Asked Questions

It is fairly well established that businesses with healthy Environment, Social and Governance (ESG) practices can deliver robust and sustainable financial performance over the long term. This has been increasingly driving investors’ interest in ESG rating or assessment since it facilitates superior portfolio selection and consistent portfolio returns.

We define ESG Rating as an objective and comparative opinion on the ability of an entity to mitigate Environment, Social and Governance (ESG) risks on its business operations and financial performance over the long term. Essentially, it is a comprehensive and relative assessment of the risk management practices adopted by a business entity to guard against the adverse impact of environmental, social and governance factors. Therefore, an ESG Rating can be a reliable indicator of long term and sustainable shareholder value. The assessment also includes a benchmarking of the ESG practices of the entity with that of the listed peers in the specific industry.

Once a company has been rated, we continuously review and update the company’s ESG scores and rating. ESGRisk.ai discontinues the rating in case of specific corporate events like merger, acquisition or dissolution, de-listing. Subscribers are informed about such discontinuation.

ESGRisk.ai has adopted a ‘subscriber-pays’ model allowing regulators, investors, companies and universities to get access to our ESG rating reports. The extensive use of technology allows a by and large automated analysis of the publicly available data and rating, which is overseen by our analysts. To ensure objectivity, the analysts’ compensation is not linked to rating outcome, neither are analysts allowed to rate companies where a conflict of interest is present. A careful adoption of business model, internal firewalls, compensations and other policies, transparent disclosure of methodology and taxonomy, ensures that the ratings are unbiased.

No, ESG rating is not a recommendation to buy, sell or hold any security, financial instruments.

Investors worldwide are investing in businesses that are more responsible. They are also looking for models that will be able to predict failures due to issues such as climate risk, social inequality and ethics in business. ESG assessments are widely accepted as a tool that helps users to evaluate company’s and industry’s performance on ESG issues.

ESGRisk.ai believes a large number of stakeholders are interested in identifying responsible and sustainable businesses (leaders and laggards) across industries. ESG rating has been accepted by the investor community as a very effective tool to identify companies aligned with their investment interests. Regulators, financial institutions, think tanks, etc. want to better understand and monitor companies and industries’ ESG performance and impact on sustainable development. Companies want to compare their performance with competitors. Across the world; environmental, social and governance related compliances are increasingly regulating the business sector and many countries have started mandatory reporting of ESG aspects. Subscribers are looking for a reliable and comprehensive assessments that provides a unbiased and predictive models, which helps them identify companies exposure and performance related to climate risk, social inequality and ethics in business. ESGRisk.ai provides subscribers the opportunity to access all companies that we have rated, a continuously growing database.

To bring uniformity in the classifications being used across sectors, SEBI has advised ERPs to use standardized industry classification published by recognized Stock Exchanges for the purpose of rating exercise, peer benchmarking and research activities.

ESGRisk.ai has covered 1000 (by market capitalisation) listed Indian companies since 2019. Currently we 1082 companies under our portfolio

We have data security protocols in place, once the published results are available, there is user level access via our secure portal. Access is only provided to your company authorized personnel; for your organizations reports.

Our taxonomy and reporting standards confirm to the following National and Global frameworks.

GRI – Global Reporting Initiative

BRSR – Business Reporting Sustainability Reporting

TCFD – Task force for Climate Disclosures framework

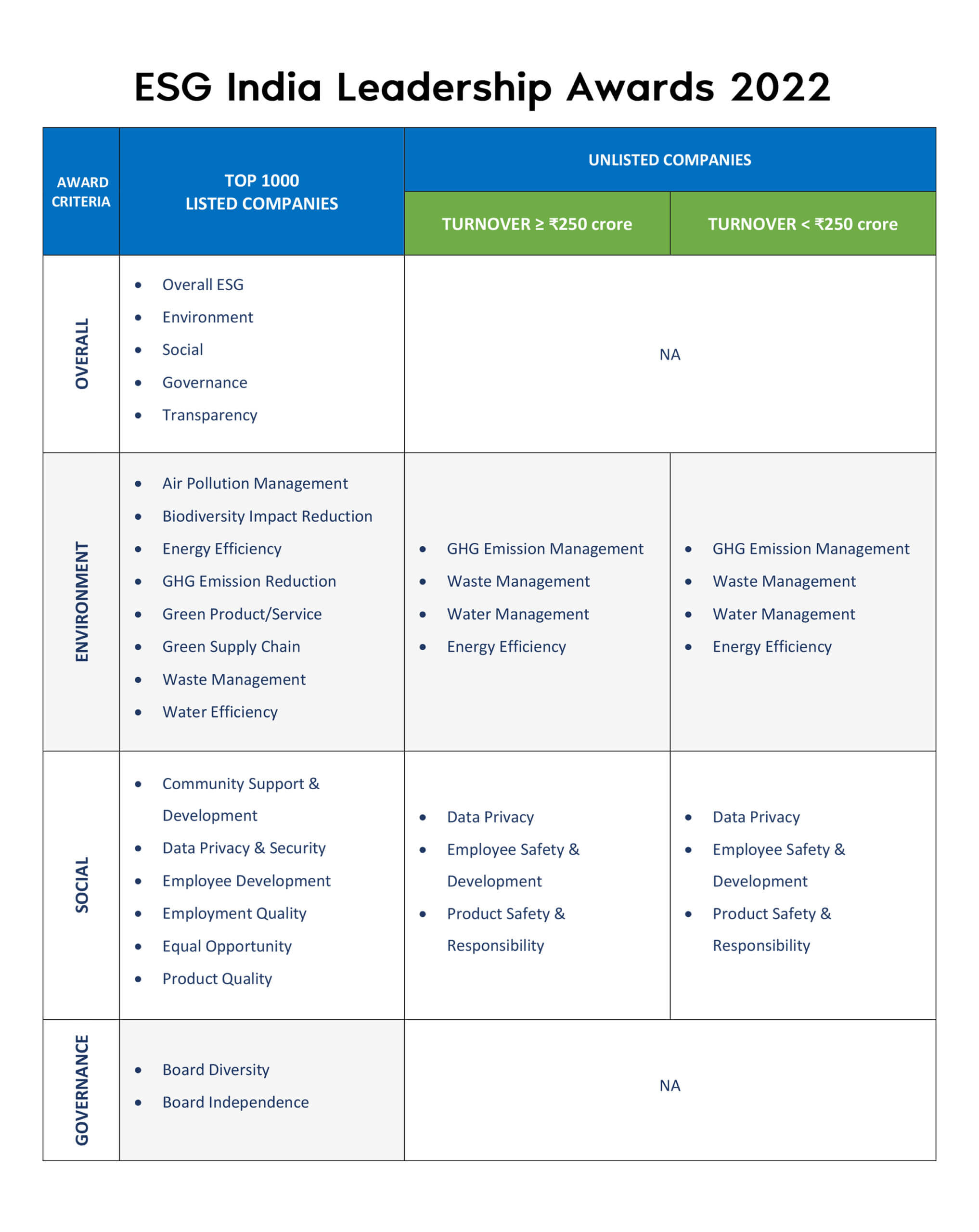

The efficacy of a company’s environmental risk management framework can be assessed by scrutinizing the results of the company’s environment management practices. Usually, the outcomes are evident through reductions in emissions, reduction in waste, better use of water, etc. and if the results are aligned with the targets the company has set for itself, the ESG risk management framework can be assumed as effective

Similarly, for social compliance, the evaluation examines how a company manages its relationships with different stakeholders such as employees, suppliers, customers and communities among others. For example, does the company take employee health and safety, career development and labor rights into consideration while developing its policies, plan location and investment outlays? Is the company engaged in community support and development? Does it require its supply chain to follow ESG principles?

For governance, the evaluation covers the board independence, diversity, leadership, executive pay, audits, internal controls, and shareholder rights. For example, the choice of its board members, independence, diversity and experience, shareholder rights measured by their ability to vote on important issues among others.

ESGRisk.ai’s ESG ratings are based on 3 categories, 19 themes with – 9 in Environment, 4 in Social and 6 in Governance.

ESGRisk.ai’s ESG assessment methodology – The performance on these 19 themes are assessed by measuring the strategy, performance and results on 35 Key Issues and 1000 indicators. This is one of the most comprehensive and robust analytical models in the industry.

Indicators are weighted and scored based on the company’s key issue-specific performance. Scores are aggregated using materiality and polarity to derive the ESG score, following which the scores are reviewed by the analysts to assign the ESG rating on a 1 to 100 scale.

We have an industry specific granular approach to our taxonomy. The materiality and relevance of environmental and social indicators vary across industries. Since not all indicators are relevant to every industry, ESGRisk.ai has identified the industry applicability of each indicator.

We currently have data of over 1087 companies.

Annual Report, Corporate Social Responsibility (CSR) report, Sustainability reports, Integrated report, BRR/BRSR report, ESGM/AGM notice, Press releases, Vote results, Company website, NGO/Government websites, News (news are monitored on a daily basis for information).

We continuously monitor news items/ corporate events which can have a negative impact on the scores of companies. Based on the severity of such news the rating for your organization is reviewed and may result in a reduction of scores.

Once the organization resolves the controversy and mitigates future risks related to the event, the same will be reviewed and the scores can get impacted positively.

The ESGRisk.ai’s ESG assessment is comprehensive and includes the following steps:

- Assigning relevancy and materiality to the indicators

- Accounting for polarity

- Scoring each indicator

- Aggregating scores of individual indicators to the overall score using weights

- Assigning ratings

- Scoring a company on transparency

The overall transparency score is calculated as: Number of indicators where performance can be ascertained through disclosures / Total material indicator Transparency scores are also calculated at different at key issue level, theme level or category level

In regular intervals, ESG Risk AI reviews the materiality of each indicator assigned to each industry as well as their weights. The revision is a forward-looking process to identify emerging issues and reduce or eliminate issues that are receding in prominence. As part of the review, ESG Risk AI updates its clients about proposed changes and seeks their feedback. In addition, we also perform discretionary reviews.

ESGRisk.ai will be providing ESG Ratings in a scale of ESG-RISK 1-100, where ESG-RISK 100/100 denotes the highest rating or score. The ratings have been categorised in the following bands and their definitions or explanations have also been provided.

ESG Rating Scale | Class | What the ESG rating signifies | |

High End | Low End | ||

Above 70 | Excellent | An ESG leader who demonstrates exceptionally strong track record in managing material ESG risks through a robust risk management framework | |

70 | 60 | Strong | An ESG leader who demonstrates strong track record in managing material ESG risks through a robust risk management framework |

60 | 45 | Adequate | A company who demonstrates adequate track record in managing material ESG risks but has inadequate risk management framework |

45 | 30 | Inadequate | A company who has a below average track record in managing material ESG risks along with inadequate risk management framework |

Below 30 | Poor | A company who has a poor track record in managing material ESG risks along with inadequate risk management framework | |

- The ESG assessment and report will help the organization to understand their current status and the progress made on various parameters.

- It will help an intra and inter industry comparison, across similar size organizations. This will enable you to identify your strengths and improvement areas.

- ESG risk management is very important for the larger society, environment, regulations and employee well-being. Reviewing ESG reports helps corporates identify their gaps and address their key focus areas.

- From an Investor’s perspective, ESGRisk.ai’s reports provide detailed research, performance of the organisation. The report simplifies the process of scrip selection and portfolio management. Besides simplifying, our ESG reports also help the investors meet the regulation requirements.

You will be given your login credentials. You can use this with an additional layer of security through an one-time password (OTP) received via e-mail every time you login. You can view the reports on our portal or e-mail reports to your mail id.

You will have access to detailed reports for the latest period.

There is no change required to be made in your existing process or systems. Most of the data is collated from published results for listed companies.

In case you want some change in disclosures or data points or would like to highlight a discrepancy, please get in touch with your analyst or write to us at support@esgrisk.ai

We do not provide advisory to companies to improve their ESG Risk management practices.

ESGRisk.ai uses publicly available information for its assessment reports. The data used for assessments can be reviewed by the company being assessed and if there are data gaps and other discrepancies or any additional information to be considered for assessments, the company can also provide these inputs to us through our data portal. ESGRisk.ai will consider the company’s feedback on data and refresh the assessment based on merits of the submission.

ESGRisk.ai’s has a very comprehensive way of finding out the impact of controversies and includes the following steps:

- Define the controversy: Clearly identify the issue at hand and understand its scope. This involves gathering information about the controversy, including its origins, key stakeholders, and the nature of the debate or disagreement.

- Identify the affected parties: Determine who is directly or indirectly impacted by the controversy. This includes individuals, groups, organizations, or communities that may be involved or affected by the issue.

- Evaluate the magnitude of the issue: Consider the scale and significance of the controversy. Is it a local, national, or global matter?

- Monitor real-world effects: Keep track of any tangible effects that emerge as a result of the controversy. This may include changes in legislation, regulations, public sentiment, economic indicators, market trends, or any other measurable impact.

Yes, companies with low ESG ratings can improve over time by implementing sustainable practices, enhancing governance structures, and addressing social and environmental risks. Continuous improvement and transparency are key to enhancing ESG performance.

Regulatory requirements for ESG reporting vary by jursdiction and industry. While some countries have mandatory ESG disclosure requirements for certain companies, for example in India we have BRSR. Others rely on voluntary reporting frameworks such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), or Task Force on Climate-related Financial Disclosures (TCFD).

Yes, ESG Rating can help companies build resilience to external shocks and disruptions by identifying vulnerabilities and implementing proactive risk mitigation measures. By addressing environmental, social, and governance risks, companies can enhance their adaptive capacity and long-term sustainability.