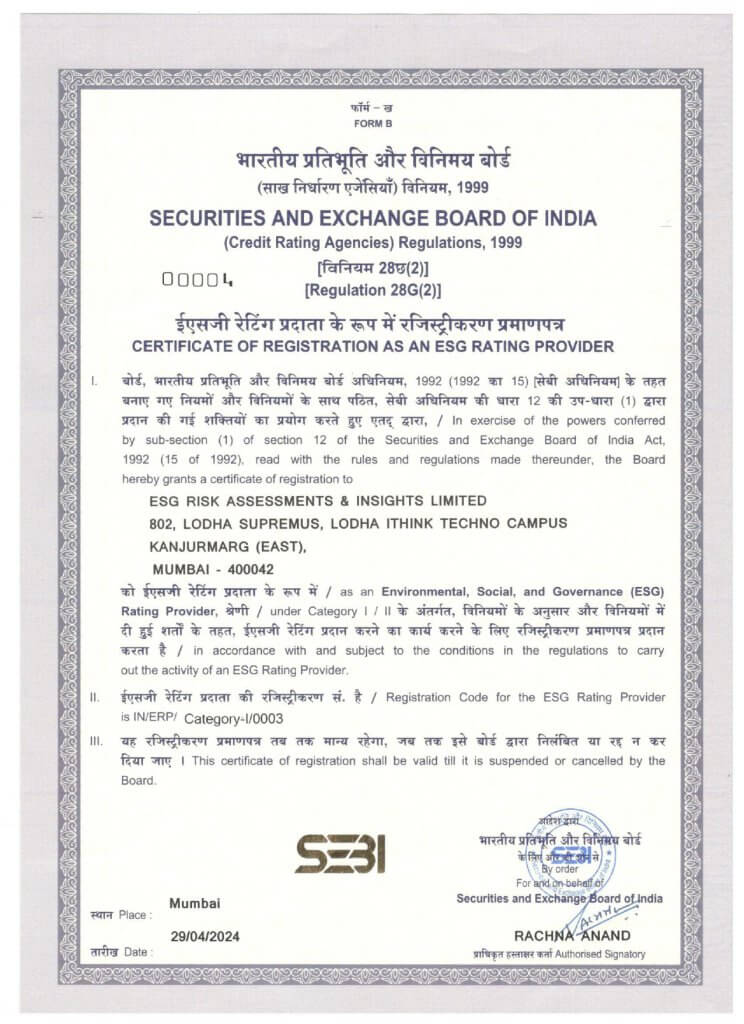

ESGRisk.ai : SEBI registered Category 1 ESG Rating Provider

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the administrative domain of Ministry of Finance within the Government of India. SEBI’s function is to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected there with.

With the increasing interest in ESG Investing, several AMCs launched ESG Mutual Funds. SEBI noticed that each AMC was using a proprietary ESG Ratings model which was varied. As a result, in 2022, SEBI directed AMFI to empanel ESG Rating Providers (ERP) to help AMCs get external and transparent analysis, ESGRisk.ai was to be one of the first ERPs empanelled by AMFI.

Subsequently, with the rise in number of firms giving out ESG Score/Ratings, SEBI initiated measures to protect investors from misinformation. Hence, it decided to release guidelines for all ERPs to follow and initiated licensing of ERPs to bring in transparency and trust.

In April 2024, having gone through the robust methodology and taxonomy of ESGRisk.ai, SEBI recognised ESGRisk.ai as a registered Category 1 ESG Rating Provider.

Stakeholders are increasingly keen to understand corporate exposure to and performance on Environmental, Social, and Governance (ESG) risks as this affects all aspects of business from portfolio investments to supplier selection, from employee engagement to project funding and from customer retention to compensation management. Regulatory thrust on transparency through Business Responsibility and Sustainability Report (BRSR) and resourcing through the Green Bond consultation paper by SEBI, accentuates the emphasis on ESG.

India’s first ESG Rating Company, ESGRisk.ai, enables corporates, investors, and bankers to understand a company’s ESG risk exposure and risk management framework through ESG scores. This helps them to directly integrate ESG factors in their decision-making process.

Our ESG scores are based on a wide range of 1000 indicators that have been selected and assigned weights based on their materiality and relevance to specific industries. Each score provides a summary of the corporate’s ESG strategy, initiatives, results, and negative news across 19 critical themes including energy, emissions, water, environmental management, ESG reporting, human rights, community, supply chain, and shareholders’ rights among others.

Download the methodology document to get a detailed understanding of the approach to ESGRisk.ai’s ESG assessment and to understand how it aligns with your decision-making process.