Net Zero Banking Alliance: Challenges and Outlook

Challenges Associated with the Net Zero Banking Alliance

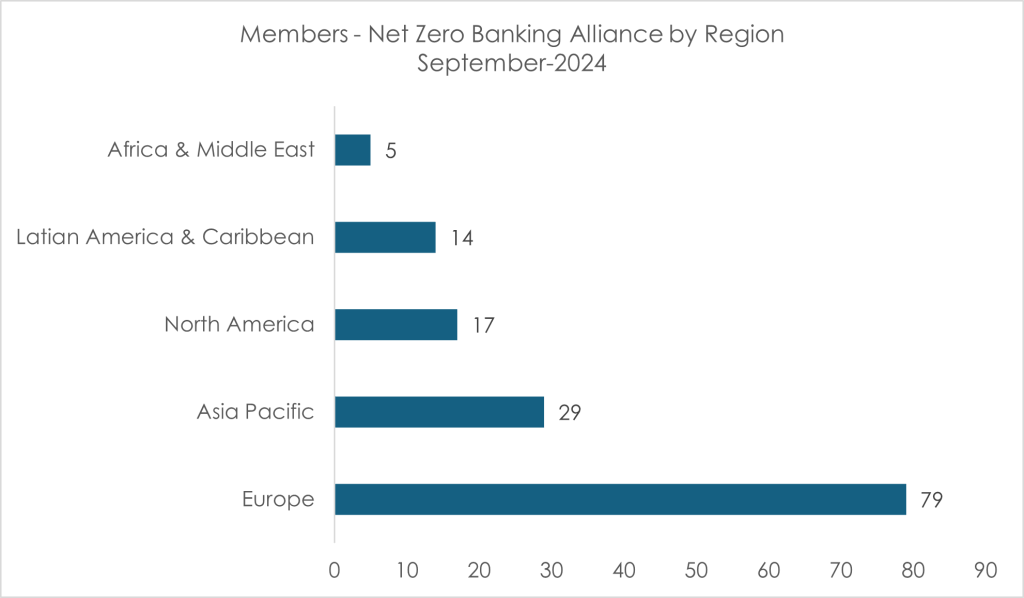

Established in April 2021, the Net Zero Banking Alliance (NZBA) operates under the UN Environment Programme Finance Initiative. It serves as the climate-focused initiative of the UN-convened Principles for Responsible Banking. As of September 2024, the NZBA encompassed 144 banks from 44 countries, representing roughly 41% of global banking assets. These banks pledged to reduce the greenhouse gas (GHG) emissions from their lending and investment portfolios to ‘net-zero’ by 2050, consistent with a 1.5ºC climate pathway.

The alliance mandated banks to set interim emission-reduction targets, decrease emissions linked to their portfolios, and transparently report progress. Additionally, it encouraged investment in initiatives such as renewable energy and reforestation to offset emissions. By joining the NZBA, banks commit to the following:

- Transition all operational and attributable GHG emissions from their lending and investment portfolios to align with pathways to net-zero by 2050 or sooner, consistent with a maximum temperature rise of 1.5ºC.

- Use decarbonisation scenarios which: are from credible and well-recognised sources; are no/low overshoot; rely conservatively on negative emissions technologies.

- Prioritise efforts where they have, or can have, the most significant impact, i.e. the most GHG-intensive and GHG-emitting sectors within their portfolios.

- Use the bank-led UNEP FI Guidelines for Climate Target Setting for Banks to set scenario-based intermediate targets for 2030, or sooner, for priority GHG-intensive and GHG-emitting sectors.

- Publish annually and share with UNEP FI for review, to monitor consistency with the UN Race to Zero criteria and evidence that action is being taken in line with:

- Progress against absolute emissions and/or emissions intensity targets following relevant international and national GHG emissions reporting protocols and/or climate portfolio alignment methodologies.

- Progress against a board-level reviewed transition strategy setting out proposed actions and climate-related sectoral policies.

- Disclosure for key sectors will be made within one year of setting the target.

- Contribute to the ongoing development of the NZBA Guidelines.

However, after the March 2024 release of updated guidelines, three progressive member banks—Amalgamated Bank, Ecology Building Society, and Triodos Bank—voiced concerns, criticizing the guidelines for allowing excessive flexibility. They called for more rigorous policies and disclosures for high-emission sectors to ensure a fair and effective transition to a sustainable planet.

Why is this important to track?

Since its inception, the NZBA has been the leading initiative claiming to align the banking sector with the 1.5ºC Paris climate targets. However, the framework presents critical challenges:

- Net-zero isn’t zero. The “net” aspect allows for continued emissions in hard-to-abate sectors, offset by carbon mitigation schemes, many of which face significant issues.

- 2050 is too distant. While transitioning sectors to low-carbon pathways takes time, immediate and substantial action is needed to address the climate emergency. However, many banks focus on “target setting” rather than executing impactful measures.

- Fossil fuel financing persists. To truly achieve net-zero, NZBA members must cease financing fossil fuels—particularly coal and the expansion of oil and gas.

These concerns are underscored by the recent withdrawal of major global banks, including Morgan Stanley, Bank of America, and Citigroup, from the NZBA during this quarter, following earlier exits by Goldman Sachs and Wells Fargo.

Political and Legal Challenges to Net Zero Banking Alliance

In the U.S., opposition to net-zero initiatives has intensified, especially from Republican-led states. Accusations claim financial institutions prioritize climate goals at the expense of economic interests.

In November, Texas and 10 other states filed lawsuits against major asset managers, including BlackRock, Vanguard, and State Street, alleging that climate activism led to reduced fossil fuel financing, lower coal production, and higher energy prices.

These lawsuits, combined with mounting political pressure, have driven banks to distance themselves from alliances viewed as restrictive or politically divisive. For example, the recent exits of Morgan Stanley, Citigroup, and Bank of America from the NZBA reflect similar concerns.

Broader Challenges Facing NZBA

In addition to political resistance, the NZBA faces issues such as:

- The quality and availability of carbon credits, essential for offsetting emissions, which must meet stringent environmental and social standards to maintain credibility.

- Operational complexities, including harmonizing emissions reporting across diverse jurisdictions and portfolios, leading to delays in achieving interim goals.

- The perception of double regulation. For instance, flights between the UK and the EEA are subject to overlapping compliance requirements under both CORSIA and regional emissions trading systems. Similarly, banks navigate overlapping climate regulations across various frameworks, complicating compliance.

So, What Now After the Exit?

Despite leaving the NZBA, these banks remain dedicated to sustainability goals. Morgan Stanley emphasized its commitment to interim financed emissions targets for 2030, working with clients to support their transition to a low-carbon economy. Additionally, the firm pledged to regularly disclose its progress.

Citigroup reaffirmed its pledge to achieve net-zero GHG emissions by 2050 across both its operations and financed activities. By 2030, it aims to decarbonize operations and has developed a Net Zero Framework focused on:

- Calculating baseline financed emissions for carbon-intensive sectors.

- Identifying climate transition pathways.

- Setting emissions reduction targets for 2030 and beyond.

- Implementing strategies via client engagement.

Similarly, Bank of America committed to achieving net-zero GHG emissions across its operations, financing activities, and supply chain by 2050. It set interim goals for 2030 and plans to mobilize $1 trillion by that year through its Environmental Business Initiative to expedite a sustainable, low-carbon transition.

Opportunities And the Road Ahead for Net Zero Banking

Despite setbacks, financial institutions have significant opportunities to lead in sustainable finance. By leveraging innovative tools such as green loans and sustainable bonds, banks can align profitability with decarbonization goals. Investments in renewable energy, sustainable agriculture, and carbon capture technologies offer additional pathways to advance climate objectives.

While the recent exits of prominent U.S. banks from the NZBA may slow collective action, they also highlight the complex interplay between political realities and climate ambitions. The financial sector must proactively address these challenges to continue driving the global shift toward a sustainable future.