Report, review, respond: What is ESG Reporting and why ESG disclosures are becoming non-negotiable

Stories have transformative potential and the power to change the world. They facilitate universal action for the greater good. Where Environmental, Social, and Governance (ESG) strategies are concerned, stories become the means to communicate an organisation’s sustainability journey. Narrating ESG strategies effectively, honestly, and telling this story in a credible way determines how an organisation is perceived in the eyes of stakeholders.

What is ESG reporting?

This is the premise of ESG reporting, a quantitative and qualitative disclosure of data of an organisation’s ESG operations. Other than communicating an organisation’s sustainability strategies, ESG reporting includes disclosures of risks and approaches in tackling material ESG issues of water use, climate change, diversity and inclusion, cybersecurity and many such key areas.

In the past, organisations would perceive ESG reporting as the means to ratchet up their image or shed any negative tag associated with the group.

Now, a realisation has dawned that winning stakeholders’ trust is just one aspect of ESG reporting. Businesses are convinced that ESG disclosures are the key to future-proofing the success of businesses.

Why is ESG reporting important?

Understandably, businesses are now increasingly conscious of being fluent in presenting ESG policies and corporate objectives.

Sustainability reporting allows stakeholders to have more faith in the organisation and understand it deeply. And companies are better equipped to adopt forward-thinking practices.

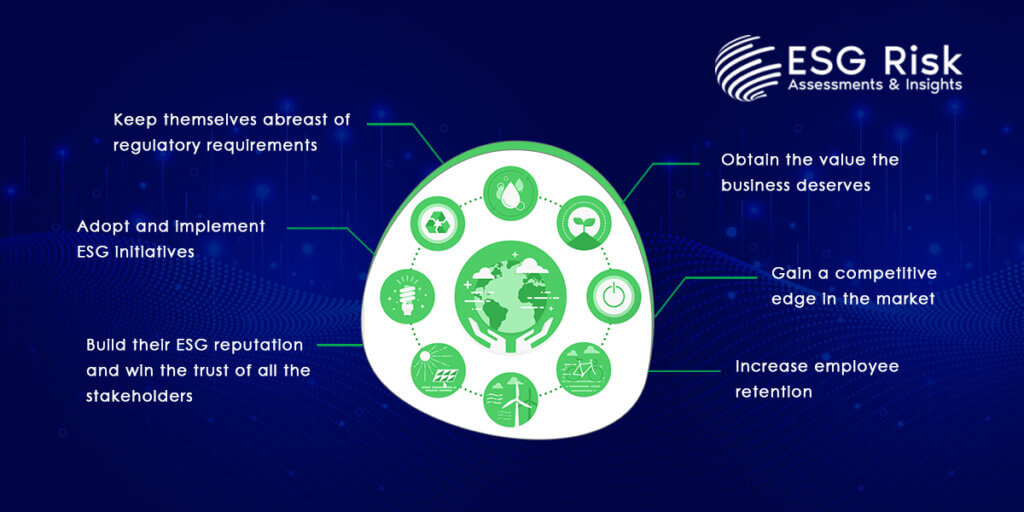

Furthermore, ESG reporting allows businesses to:

Keep themselves abreast of regulatory requirements.

Adopt and implement ESG initiatives.

Build their ESG reputation and win the trust of all the stakeholders.

Obtain the value the business deserves.

Gain a competitive edge in the market.

Increase employee retention.

Naturally, the execution of ESG reporting, part of a non-financial performance criteria, calls for the involvement of specialists. Only with a structured approach can all the information be collected in one source.

What is required for ESG reporting?

Organisations create their own teams of specialists or outsource their ESG reporting requirements to external agencies. The global ESG reporting frameworks explores the reporting methodologies, highlights stakeholders, understands the group’s ESG reporting framework and gauges the standards.

These experts then call out key data that serve as a guide to further an organisation’s ESG initiatives.

A significant step in the process is creating a communication strategy, essentially involving all the decision-makers and stakeholders in the wide community.

It’s also imperative that businesses include ESG reporting in their annual reports to establish the sustainability of the business.

How ESG reporting is gathering steam...

Quite expectedly, sustainability-related disclosures are gaining momentum worldwide, with organisations getting inspired by international reporting frameworks such as the GRI (Global Reporting Initiative) and PRI (Principles for Responsible Investment).

These hallowed institutions have become a global industry standard and common language for reporting sustainability-related activities.

One of the six PRI principles says, "We will seek appropriate disclosure on ESG issues by the entities in which we invest."

The increasing awareness of ESG reporting and disclosures is seen in the trends worldwide.

In June last year, the G7 finance ministers mandated climate reporting in line with the recommendations of the taskforce on Climate-related Financial Disclosures (TCFD).

Elsewhere, the World Business Council for Sustainable Development (WBCSD), in association with the Climate Disclosure Standards Board (CDSB) and Ecodesk, launched the Reporting Exchange five years ago. The Reporting Exchange is aimed at providing clarity on how to report on sustainability issues in a clear, concise and informed manner.

The New York Stock Exchange (NYSE) mandates that listed companies disclose a code of business conduct and ethics.

China has seven regulations, essentially instruments of mandatory disclosures on sustainability. Large companies in China have to submit a separate report on environmental disclosures on the Shanghai Stock Exchange.

Similarly, the EU Taxonomy, which came into effect in 2020, imposes disclosure requirements for financial market participants on the ‘E’ aspect of ESG and makes a concerted effort to counter greenwashing.

This brings us to the Indian context.

How is ESG reported in India and what is the future?

In May last year, SEBI issued a circular introducing the Business Responsibility and Sustainability Report (BRSR) that replaced the Business Responsibility Reporting (BRR). Based on the principles stipulated in the National Guidelines on Responsible Business Conduct, the format outlined mandatory ESG policies for the top 1000 listed companies by market capitalisation.

The guidelines are influenced by leading international standards such as the Paris Agreement, International Labour Organisation (ILO) Core Conventions, UN Sustainable Development Goals and UN Guiding Principles on Business and Human Rights and global reporting frameworks such as GRI, TCFD etc . They address issues such as fair and equitable labour policies, human rights, environmental concerns and business ethics.

The BRSR is aimed at securing standardised disclosures by companies on ESG parameters to help them make informed ESG-related decisions and enable long-term value creation.

Meanwhile, organisations are joining forces with credible ESG rating agencies to not only seek assistance in implementing BRSR, but also enforce a more structured ESG reporting system. It’s in their interests to stay invested in a value-based, sustainable business.

How does ESGRisk.ai help in ESG reporting?

ESGRisk.ai helps companies disclose their E, S and G initiatives and policies via data portal called ESG India 360°

For instance, ESGRisk.ai’s risk assessment report helps companies understand their current status and performance on various material key issues like GHG emission, human rights, board diversity, community support and development etc with the help of gap analysis.

Serving as a comprehensive ESG reporting guide, ESGRisk.ai, India’s first ESG rating agency, assesses key strengths and weaknesses and benchmarks ESG risk management framework with industry peers.

Our solutions are designed to help investors quickly understand the organisation’s ESG risk exposure and risk management framework, enabling investors to directly integrate ESG factors in their portfolio construction and management. While all the data used for ESG assessments is collected and analysed from publicly available sources, the ESG reporting transparency becomes significant.

How ESGRisk.ai help the market participants?

The road ahead like most progressing countries, India grapples with several ESG issues, compounded by socio-economic diversity, ambitions at the expense of the environment, disregard for human rights, and ignorance of the tenets of sound governance.

Strong ESG reporting standards thus become a poignant tool to cut back on waste and mitigate risk in the workplace while bettering operational efficiencies of businesses. ESG reporting serves as the means to facilitate sustainable growth, improve the bottom line, and give an accurate interpretation of the business. Moreover, it’s noted that Public Sector Undertakings (PSU) in India are getting increasingly serious about ESG implementations – reporting in particular – to shore up divestment processes and maximise value creation. It’s not perceived as a forced regulatory model but a tool to attract investors.

A recently published article in the Hindu Business Line reads: “PSUs are poised to lead the ESG landscape in India. What’s required is a concerted effort to improve voluntary disclosures, highlight sustainability initiatives, publicise targets, and build a mechanism for independent audits and ESG assessments.”

It adds: "With greenwashing being a common phenomenon, most of the potential buyers are wary of claims companies make about their own achievements. Effective demonstration of initiatives taken towards ESG is the missing link. This is done through an audit, independent validation and benchmarking of the voluntary disclosures."

ESG reporting presents an opportunity for the board approved ESG policies that, in turn, translates into actionable outcomes and positively impacts the business. It all comes down to the power of communicating a credible story.