Role of ESG reporting in sustainable economic development in India

Mar 25, 2021

SESSION 1: How does corporate performance in the management of environmental, social and governance (ESG) risks link to sustainable economic development? held on 25 March 2021

Key insights

In a time where climate risks and pandemics affect our lives and work, ESG has gained tremendous importance among investors, regulators, international agencies and the private sector worldwide. Clear steps to promote ESG risks management in the corporate sector are being taken. In India, ESG as a subject is still nascent. However, climate change, the loss of biodiversity, water scarcity, pandemics like COVID, corruption and social tensions, to mention some, are calling for action. Indian regulators and international investors have made it their task to take concrete steps to put India onto the global ESG map. Besides compliance, a company that integrates good environmental, social and governance practices into its core strategy, opens the doors to untapped investment opportunities, immense cost savings and business expansion.

To deliberate on how corporate performance in the management of environmental, social and governance (ESG) risk links to sustainable economic development in India, we were joined by an esteemed panel comprising of Dr Aditi Haldar, Regional Hub South Asia Director of the Global Reporting Initiative (GRI), Mr Gareth Phillip, Manager Climate and Environment Finance of the African Development Bank and Mr Ramnath Iyer, Cofounder, ESG Data & Solutions. Mr Sankar Chakraborti, Group CEO of Acuité Ratings & Research and Chairman of ESGRisk.ai set the background in his opening speech. The webinar was moderated by Inga Luehr, Strategy Consultant at ESGRisk.ai.

In the opening speech, Sankar Chakraborti, Group CEO of Acuité Ratings & Research and Chairman of ESGRisk.ai, provided a brief background on Acuité Group and ESG Risk Assessments and Insights (AI). He then drew attention to the changing risk landscape where environmental, social and governance risks increasingly affect businesses and countries, which is also why regulators, investors, banks and customers pay increasing attention to companies’ ESG performance. He continued to highlight that, “though ESG as a subject in India is only nascent, regulators have made it their mandate to promote responsible business practices” that require companies to address ESG risks and thereby contribute to the country’s sustainable development targets. On the other hand, he says, “banks, asset managers and investors increasingly use ESG performance to guide their investment decisions. A good indicator is India’s share in ESG themed investment, which is a mere 7% as against US, Canada and Australia that are hovering around 50%.” He points out that with “these developments in place, India’s ESG themed investments are estimated to increase to 30% by 2030, equal to over Rs. 20,00,000 crore.” Addressing companies and their role in managing ESG risks, Sankar Chakraborti, says, “the management of ESG risks in Indian corporates is becoming a matter of compliance and key to stay competitive.” He stresses that “it is evident that companies and countries need to act fast to avoid cost and damages brought up for them through Environmental, Social and Governance (ESG) risks. ” To do so, he highlighted the importance of ESG assessment tools like those developed by ESGRisk.ai. “Our tools help companies to benchmark their performance both domestically and globally against their industry peers, providing them with an independent perspective on how they fare in the management of their ESG risks”. ESGRisk.ai informs companies and investors on companies’ ESG performance.

With this background, the panel then discussed how sustainable reporting and ESG assessments can help companies meeting their compliances while making them more competitive and even contributing to development targets like climate adaptation, prescribed under the Paris Accord.

Dr. Aditi Haldar, the Regional Hub South Asia Director of GRI and sustainable development expert, says that “the first and important step that corporates need to consider is using Sustainability Reporting as an approach. Their ultimate purpose of reporting should be to build transparency and sustainability as a culture within the organisation.” GRI provides sustainable reporting standards for companies to report their impacts in a global common language, which in turn help them identify their performance, opportunities and risks. “In Sri Lanka, the number of listed companies that are using the Global Reporting Initiative’s (GRI) standards is quite high.” She explains, that “in India, since the number of listed companies are too many, SEBI in 2015, released a notification on business responsibility reporting. The framework provided by SEBI, is easy to implement and because it is given by the regulator, companies need to abide by it.” She says a lot of companies of the top 500 (based on market capitalisation) are using the SEBI Business Responsibility Report but not the GRI standard. However, according to our study, 74 of the top 100 companies are using the GRI standards for many years.

Taking the discussion forward, Mr. Ramnath Iyer, Co-founder, ESG Data & Solutions stresses that “ESG risks are financially material to companies. Investors are now using ESG disclosures to quantify the risks and see if investments in their selected companies are going to be secure or exposed to financially material risk. Thus, greater transparency automatically means a better ability to assess the risks leading to improved investor confidence. The assessments and ratings play an important role to evaluate the detailed disclosures spelt out by the companies in their documents, while also looking at the industry in general and comparing it to the global practices. An ESG assessment/rating company does convert the detailed 200-250 pages of disclosure into 20 pages of relevant insights, ensuring all necessary checks and comparisons, putting it in a format that is easy to consume for investors and companies to support in their effective decision

making”.

Speaking on adaptation and mitigation technologies, Mr. Gareth Phillips, Manager Climate and Environment Finance in the African Development Bank illustrated how sustainable reporting and ESG assessment tools can help foster adaptation to climate change. He says “there are good examples of how adaptation can have a positive impact on companies, for example enabling staff to work from home during the period of adverse weather. Moving forward, its adaptation to climate change will require a lot more attention than we are giving it now. Mitigation technologies like renewable energy are easy to invest in because of the cash flow through the sale of electricity and potentially carbon credits. However, most adaptation projects do not have associated cash-flows.

Even if they do, they tend to be long term and marginal. To fill the financial gap, the African Development Bank is piloting a new mechanism called “Adaptation Benefit Mechanism” which is designed to pay project developers for delivering certified adaptation benefits.” He says ESG and adaptation are interlinked, which can be illustrated along the value chain. For example, it is important to ensure that a company’s supply chain is resilient for natural calamities such as floods or droughts, and being able to report that through ESG report will definitely add value.”

The session ended with panelists answering questions from the audience:

How does the BRR get picked up by GRI and ESG reports?

BRR addresses some of the key areas but it needs to go beyond this (environmental responsibilities, supply chain

management, distribution of operations & related compliances). The Business Responsibility and Sustainability Report (BRSR) – currently being finalized by SEBI – will make reporting of environmental and social aspects mandatory. It is to be seen which sections will be included if it will be mandatory and for whom it will be mandatory.

Ramnath Iyer, expects 80% of what needs to be disclosed under GRI, will be captured under BRSR (compared to approx. 30% in the case of BRR). Aditi Haldar, added thatregardless of what reporting standard and guideline, the reporting agency’s disclosures are key in respect to how much the data can be used (material activities vs. simple reporting of related events and activities). Sub-optimal reporting results in users and reporter losing out. Key is to use the reporting framework as intended and properly (uptake of the standard). Inga Luehr added that this is one of the reasons why ESGRisk.ai’s ESG reports also rate companies on the transparency (number of disclosures that positively and negatively affect the overall ESG scores), providing investors a sense on how much the ESG rating is being based on the complete picture.

What are the data sources for ESG reports?

One approach is to use disclosures in the public domain that are structured and used for the assessments. An alternative approach can be elaborate company surveys. ESGRisk.ai is using a hybrid approach by providing companies a review options to further add to the disclosures that influence the rating.

As we wait for the comprehensive standard, what consolidation effort by the standard setters are suggested and feasible?

Collaboration to harmonize different reporting frameworks. It is difficult. Each reporter needs to decide which framework to follow to which extend based on e.g., what are regulators, investors and ESG rating companies demanding. For mainstreaming ESG Risk assessments and getting everyone on board, the government needs to mandate sustainability reporting. When a government mandates ESG rating through a collective mechanism that is good for everyone, it also creates a mechanism that contributes to sustainable economic development.

How can lawyers be involved in the ESG rating

Aditi points out that lawyers come in to see when disclosures are made in understanding the disclosure vs. regulatory requirements. Lawyers need to link the multiple dimensions of environmental social and governance aspects to regulations (widen approach). Sankar Chakrabarti added that lawyers are already deeply involved in ESG issues on the failure to comply to ESG related compliances and/or manage with ESG risks. Examples are controversies that result into legal issues. Companies should be enabled through a better understanding of their ESG performance to prevent certain controversies and subsequent legal and reputational costs. Lawyers need to diversify their approach in assisting corporates in the prevention

of controversies

What percentage of Indian funds are ESG driven?

India’s ESG themed assets under management are currently estimated to be 7%. It is expected to increase to 30% by 2030.

What companies are going beyond the BRR reporting requirements?

Ramnath Iyer responds that the list is long. In fact, there is no dearth of disclosure, companies are getting more and more transparent. The reason is that India, though it is an emerging market, it is part of the global supply chain, which demands adequate ESG disclosure. The wrong perception that India is under disclosing (common misconception) needs to be overcome.

Are banks using ESG assessments at the sovereign and company level to assess their portfolios?

Gareth Phillips highlighted that the African Development Bank is a recipient of many questionnaires assessing their ESG performance (procedures and processes and how are they being monitored). ESG rating is relevant for the credit score (AAA) and supposed to facilitate good credit ratings. Ramnath Iyer adds that the since the financial risk emanating from ESG aspects are material and unless banks are incorporating ESG assessments, they will face contingent requirements that lar lurking in the future, reducing their repayment of loans. Also, there are increasing financial requirements for environment aspects (ref. India’s Paris Accord commitments), like energy efficiency, transportation systems, etc. With India being a bank driven country, banks need to have their practices in place to ensure sustainable development through active lending decisions. Yard sticks on assessing how a company contributes to climate change activities are different to those in “normal project yardstick” (e.g., climate projects are not immediately viable). Unless banks can clearly identify ESG benefits, their lending rates will not be justifiable. Ramnath would not be surprised if there is clear stipulations, regulations from RBI for banks coming up in the near future to assess how climate change and other ESG yardsticks need to be incorporated into banks’ lending decisions. This is already happening in Europe and US and other Asian countries

About ESGrisk.ai:

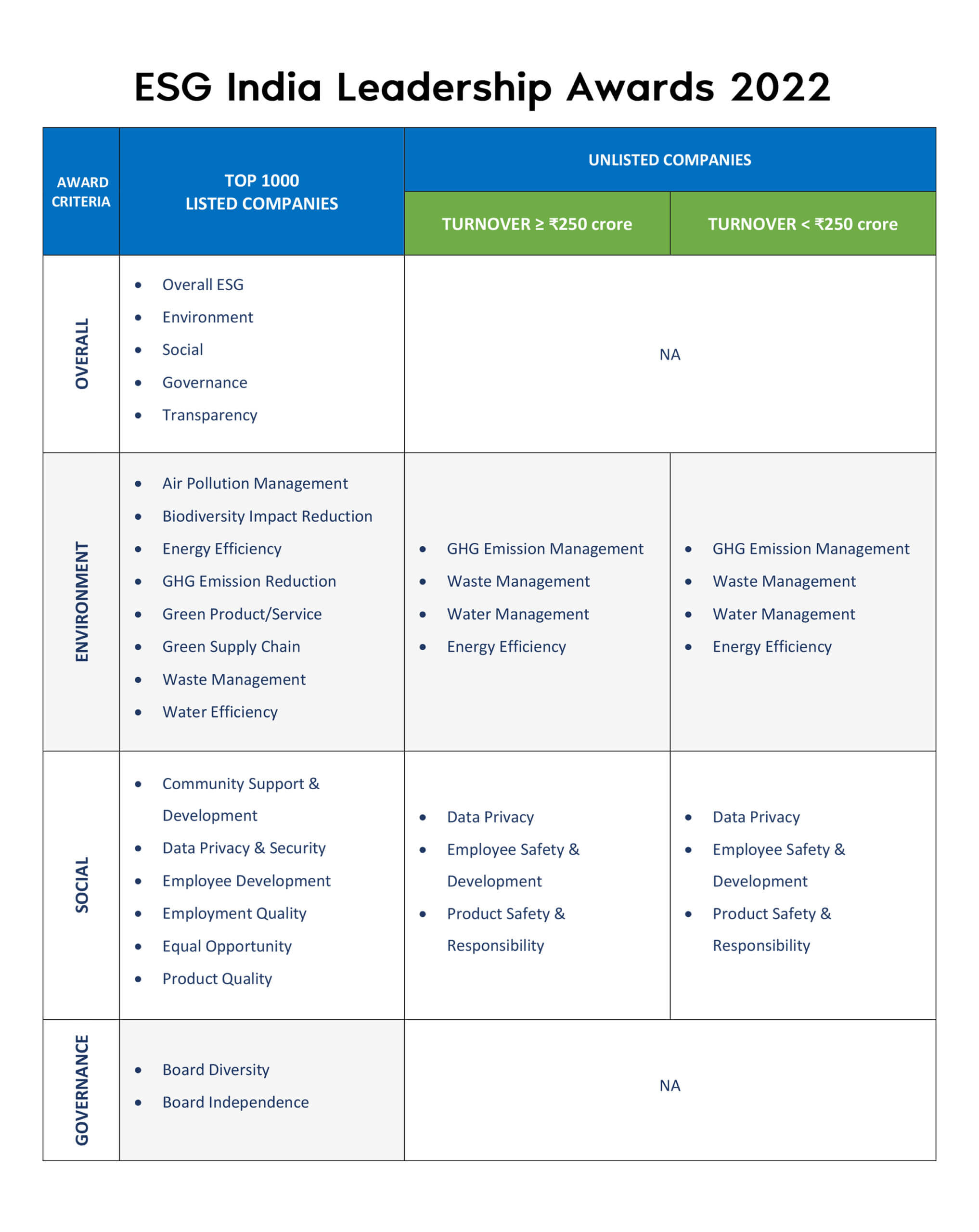

ESGrisk.ai (ESG Risk Assessments & Insights Limited) is India’s first ESG Rating company andis a wholly owned subsidiary of Acuité’s Ratings & Research Limited. ESGrisk.ai’s assessment methodology covers company performance on Environment, Social and Governance parameters as well as their reporting transparency. Apart from ESG Ratings, the company has developed ESG assessment tools and electronic workflow.

About Acuité’s Ratings & Research Limited:

Acuité is a full-service Credit Rating Agency registered with the Securities & Exchange Board of India (SEBI). The company received RBI Accreditation as an External Credit Assessment Institution (ECAI) for Bank Loan Ratings under BASEL-II norms in the year 2012. Acuité has assigned ratings to various securities, debt instruments and bank facilities of entities spread across the country and across a wide cross section of industries.