ESG analysis of power industry 2021-2022

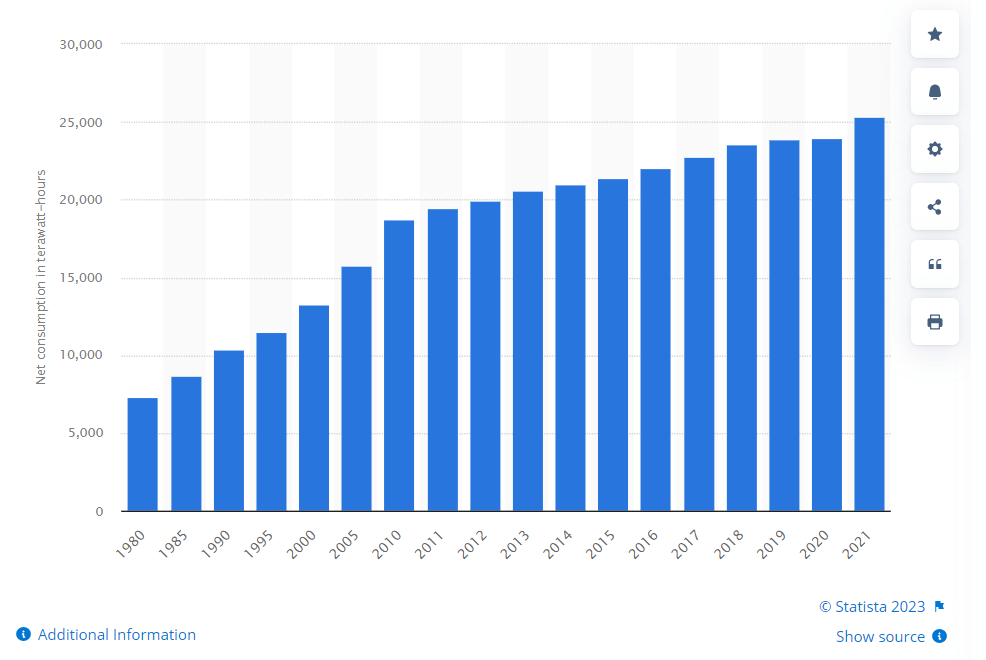

The global population is expected to increase by approximately two billion over the next two decades. With the standard of living growing by the day, the demand for electricity is expected to increase 50% by 2040. Electricity consumption in the world has reached approximately 25,300 terawatt-hours in 2021 (source Statista). The numbers may have risen in recent times.

The global population is expected to increase by approximately two billion over the next two decades. With the standard of living growing by the day, the demand for electricity is expected to increase 50% by 2040. Electricity consumption in the world has reached approximately 25,300 terawatt-hours in 2021 (source Statista). The numbers may have risen in recent times.

Let’s zoom in on the scenario in India. In May 2021, India was the third-largest producer and second-largest consumer of electricity globally, with an installed power capacity of 383.37 GW (source IBEF). It’s irrefutable that India’s electricity demands are reaching new peaks. Growth in industrialisation and access to electricity in rural areas have further boosted the need for energy.

And this is a concern to humankind. For aeons, we have depended on non-renewable sources such as fossil fuels, oil, coal, and natural gas to meet our energy needs. These energy sources take thousands of years to form, but they’re exhausted in no time. They have to be extracted and burned to create the energy we need.

Now, the unsettling realities. As of now, coal accounts for 44% of India’s major energy sources and 70% of its power generation. As one of the leading CO2 emitters, coal-based power generation causes significant environmental damage.

According to the World Health Organization (WHO), burning of traditional fuel sources for cooking (including biomass, coal, and kerosene), leads to approximately 3.8 million premature deaths each year (source: WLPGA).

Furthermore, the power sector is a significant contributor to greenhouse gas emissions that have far-reaching effects on the environment and health. In addition, greenhouse traps heat causing climate change and contributing to air pollution and smog.

Burning fossil fuels to generate electricity has been a major contributor to the emission of greenhouse gases. According to a report published by activesustainability.com, fossil fuels account for 80% of the current global demand for primary energy.

Understandably, organisations are determined to improve the energy efficiency of their operations and switch to renewable energy systems. Hydroelectric, wind, solar, bioenergy and tidal energy are self-replenishing systems that have a low carbon footprint.

The word ‘low’ is operative here. Renewal energy systems, while infinitely better than non-renewable energy sources, remain a work in progress. Installation of solar panels, for instance, generates a certain amount of greenhouse gas. Also, the creation of solar, wind and hydro systems use up land mass, which adversely impacts the environment. This risk can be minimised using non-greenfield areas. The downside is limited compared to the benefits that non-renewable sources of energy offer.

Companies are adopting cost-effective, measurable Environmental, Social, and Governance (ESG) solutions to meet global decarbonisation goals. With the use of renewable energy sources, companies are consciously transitioning from carbon-intensive to carbon-neutral technology. To cite an example, the cement industry is a massive CO2 emitter. Cement manufacturers are adding solar and wind energy generating capacities, besides using Waste Heat Recovering System (WHRS) in their plants. Similarly, pharmaceutical companies are making long-term Power Purchase Agreements (PPA) with energy companies that guarantee clean electricity. That said, given the resource-intensive nature of the industry, India has a long way to go to make a transition to clean energy.

The renewable benefits and alternatives

Compliance

With industry emission standards

Carbon Capture Technology

Can be captured, stored and used in other applications

Energy Storage Solutions

Are safer, cost-effective, and offer less space

Hydrogen Gas

Lightweight, offers easy storage, and has zero-emission attributes

Net Zero Target

Companies can join the global vision of helping their countries achieve the net-zero target by 2050

More Jobs

Growth of renewable energy translates into more jobs

Other Benefits

Improved business reputation and consumer confidence are the other benefits

However, ESGRisk.ai notes that the energy sector still needs an ESG push in India, specifically in the environment category.

- According to ESGRisk.ai data, India’s first ESG rating provider, the industry is a poor performer in the material issues of managing water pollution and air pollutants, with an average score of 20% and 22% respectively. The scores aren’t impressive in energy efficiency (25%), environmental management (32%), GHG emissions (26%) and Green Supply chain (21%).

- In the social category, the industry has been delivering well on the key issue of human rights with a score of 63%.

- Where governance is concerned, power companies have recorded an impressive average of 86% in the material issue of board independence and 66% in the key issue of board diversity. ESGRisk.ai notes that the scores are impressive in antitakeover mechanism (61%) and audit committee functioning (77%).

- However, ESGRisk.ai data reveals that only 37% of power companies report their ESG practices as per GRI guidelines.

ESG framework, the way forward

Implementing a good ESG strategy is one of the key challenges that power companies face. This holds especially for oil and gas firms that are under intense scrutiny for their ESG performance. ESG initiatives thus become essential to foster innovation in the energy industry and lower risks. Businesses can establish action plans and track performance metrics such as energy diversification, carbon footprint reduction, and sustainability of natural resources with the help of a dynamic ESG framework. Energy firms may win stakeholders’ trust by focusing on ESG, demonstrating social responsibilities and preparing organisations for the future of work.

Why ESGRisk.ai…

Eventually, it’s ESG ratings that lend credibility to their ESG efforts. For example, ESGRisk.ai’s ESG ratings offers unbiased opinion on a power company’s ability to mitigate emerging risks associated with ESG. In addition, through ESGRisk.ai’s ESG ratings, businesses associated with the energy industry may improve relations with shareholders, have more investment opportunities, and access to low-cost capital.

It’s seen that divestment opportunities for India’s energy PSUs have hit a roadblock owing to a lack of ESG ratings. PSUs with low ESG ratings may struggle to line up investors who may not be convinced about an energy company’s ability to withstand shocks. An ESG rating may not just establish the energy company’s current positioning on complying with ESG principles but also drive actionable insights that are measurable regularly.

The demand for ESG programmes in the energy sector is rising by the day. High-emitting firms are in danger of withering and perishing as climate change concerns intensify. It’s in their interests to take the ESG route here and now.