ESGRisk.ai in News

April 02, 2025

In the global pursuit of net zero emissions, India emerges as a unique player that is slowly but steadily poised to win the race. Our methodical approach positions us to smartly harness international financing.

January 25, 2025

“Along with helping corporates in risk aversion and future-proofing their approach, double materiality also helps them take well-informed decisions that do not hinder their relevance in a rapidly changing global dynamic.” Says our Chairman, Sankar Chakraborti, in his recent explainer published in Sustainability Karma.

December 15, 2024

As the world’s third-largest greenhouse gas emitter, India requires over $10 trillion to achieve its net zero emissions target by 2070. Policies incentivising the solutions for the climate change juggernaut is the need of the hour. The Reserve Bank of India has already set up a dedicated group and released frameworks for green deposits and climate risks disclosures.

December 03, 2024

As more companies embrace BRSR reporting, we can expect a reduction in the discrepancies between announced ESG initiatives and the actual performance outcomes. This shift will enhance corporate accountability, fostering greater trust among investors in corporate sustainability claims.

December 02, 2024

“Getting IDs on bank boards qualified in ESG will take a decade more, but in the interim, banks should bring in experts on the subject to assist the board,” feels Sankar Chakraborti, chairman-ESGRisk.ai and group CEO-Acuité Ratings. He concedes a few private banks have made progress on ESG, but state-run banks “have some distance to catch up with them. It’s an evolving area and it will be sometime before we settle down on these matters”.

November 29, 2024

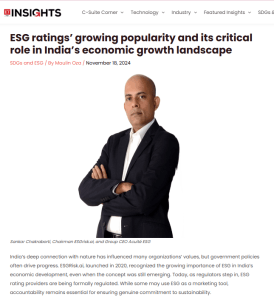

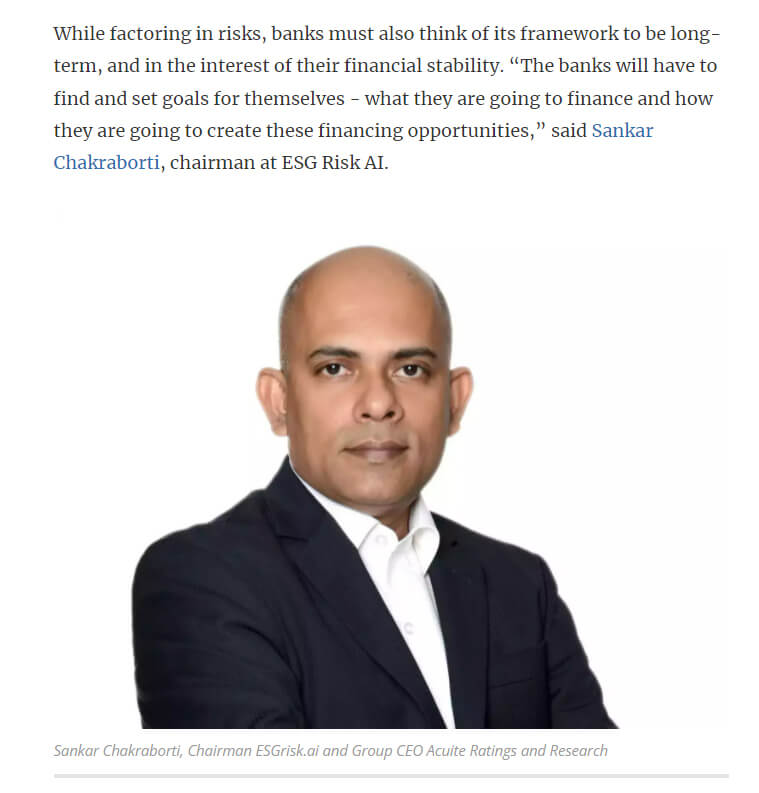

Sankar Chakraborti, Chairman – ESGRisk.ai and Group CEO – Acuité Group

“As stringent regulations and heightened investor awareness reshape the ESG landscape, genuine sustainability efforts are emerging as a competitive advantage. With India positioned as the preferred destination for global corporations implementing the China+1 strategy, robust ESG assessments, rigorous audits, independent validation and transparent reporting of voluntary disclosures will enhance governance and attract responsible investments, ensuring long-term business success.”

November 18, 2024

Speaking exclusively to ET EDGE INSIGHTS, Sankar Chakraborti, Chairman ESGrisk.ai, and Group CEO Acuité shared his thoughts on alternative sovereign rating models, ESG practices in Indian companies, global and local expectations, and the risk of ESG negligence. He stated that ESG ratings have become an integral part of the present business landscape and are set to remain, playing a crucial role in shaping sustainable practices and investor decisions.

November 12, 2024

When the two ills of poverty and climate change collide, humanity suffers. As the world steers the complexities of climate change, the intersection of food security, trade policies and humanitarian concerns has become critical. Export controls, especially for food products, are quite reasonable from the perspective of domestic food security and self-reliance. However, the situation is concerning when seen from the lens of low-income food-importing nations.

June 05, 2024

“India’s GHG (Greenhouse gas) emissions per capita is lower than China, Japan. The challenge for the new government would be to keep the per capita carbon emissions lower while ensuring there is enough supply of power,” said Sankar Chakraborti, CEO at Acuité Ratings & Research. He further added that the government should focus on making more investments and resources available for the renewable energy ramp up.

May 28, 2024

Explaining the need for a customised ERP model, Sankar Chakraborti, Chairman of ESGRisk.ai, a subsidiary of Acuité Ratings & Research Ltd, says, “Take, for example, the use of coal in India, which is a big concern (among global players). Now, you cannot have a situation where everybody will stop using coal, so that is an aspect that rating agencies will have to consider in terms of building their tools and models.”

May 27, 2024

Sankar Chakraborti, Chairman ESGrisk.ai and Group CEO, Acuité, says that this initiative aligns with the FY24 Union Budget’s goal of simplifying regulations, reducing compliance costs, and considering public and industry suggestions.

May 04, 2024

Outlook Planet covers ESGRisk.ai on ratings agencies getting ESG license in the story

Sankar Chakraborti, Chairman, ESGrisk.ai, and Group CEO and MD, Acuite, says, “Globally ESG rating business models were criticized. Some experts claimed these ratings from some established players could not accommodate nuances of developing economies, creating an inherent bias. Also, the experts opined that due to wide divergence and a non-standard approach, the ratings were not as effective in removing information asymmetry as much as it should have.”

April 30, 2024

The adoption of ESG practices by corporates will contribute to achieving the government’s objective of reaching net-zero emissions by 2070.

The integration of ESG considerations into policies and business operations is also expected to promote innovation, resilience, and competitiveness across industries.

“Understanding ESG factors and incorporating their principles into predictive models is crucial. We anticipate a future where corporate failures may be attributed to neglecting these factors more than ever before”, said Chakraborti.

April 15, 2024

To help MSMEs achieve better ESG ratings and secure cost-effective lending, financial transparency is critical for MSMEs, says Sankar Chakraborti, Chairman of ESGRisk.ai and Group CEO of Acuité Ratings.

April 15, 2024

Indian MSMEs are not prepared because most MSMEs are not financially educated and lack professional resources to manage finances. As a result, they lack an understanding of how lending decisions are taken at banks or other financial institutions. So, imparting financial education is of utmost importance for MSMEs. This is where ratings come into play.

February 21, 2024

PSUs must transform ESG into a strategic growth engine. Setting aspirational targets, overhauling ageing infrastructure, empowering their workforce, and forging deep stakeholder partnerships are non-negotiables. Decisive action unlocks a treasure trove: capital flows, mitigated risks, a competitive edge, and a legacy of sustainability. The choice is stark: become ESG pioneers or risk irrelevance. The future beckons; will PSUs seize it?

December 07, 2023

ESGrisk.ai completed three years of incorporation in November 2023. Sheetal Agarwal of IIFL caught up with the Chairman to get insights into their journey and evolution of ESG space in India.

November 29, 2023

In conclusion, we can achieve these goals and have a better tomorrow. By making the transformative changes enshrined in the 2030 Agenda of the UN, we can weather the global shocks, build resilience, and emerge stronger. The 2023 Global Sustainable Development Report highlights the significant contribution of science, and evidence-based actions, to counter uncertainty and address global challenges – the eradication of poverty, ending hunger, tackling climate change, reversing biodiversity loss and reducing inequality, among others.

August 27, 2023

“Indian society is inherently efficient. However, with more and more Western influence, things are changing. On one hand, our children are extremely aware of climate change, but on the other, the ability to recycle is going down.” – said our Chairman Mr. Sankar Chakraborti, in an exclusive interview with Business Standard:

June 21, 2023

Such frameworks also provide long-term sustainability by comprehensively safeguarding profits, people and the planet, say experts. “Assimilating environmental, social and governance factors and measuring the impact created can help in future-proofing of enterprises with respect to the opportunities and threats that cannot often be measured,” says Prosenjit Ghosh, Director at ESGRisk.ai, and Group Chief Business Officer of Acuité Ratings & Research.

June 08, 2023

Authored article of Mr. Sankar Chakraborti Chairman of ESGrisk.Ai & Group CEO of Acuité Ratings & Research, in The Hindu Business Line

May 29, 2023

May 05, 2023

In collaboration with ESGRisk.ai, India’s first ESG rating provider, Greenline (Green Planet Logistics Pvt Ltd) enables its clients to officially account for emission reduction in their statutory and ESG reporting, covered by India Shipping News

April 20, 2023

Mr. Prosenjit Ghosh, Director, and the Group Chief Business Officer at Acuité Ratings & Research, shares his perspective with CNBCTV18 on the growing popularity of ESG funds in India with respect to the recent guidelines and awareness created by the regulators.

Mar 15, 2023

Our group CEO of Acuité Ratings & Research, Mr. Sankar Chakraborti shares his perspectives on recent move by SEBI on ESG disclosures.

Feb 28, 2023

In an interview with IIFL Securities (Indiainfoline), Our Chairman and the Group CEO of Acuité Ratings & Research, Mr. Sankar Chakraborti, talks about how investors can assess the ESG risks of a company and how they are trying to look beyond the greenwashing done by corporates.

Feb 22, 2023

“ESGRisk.ai’s study revealed that from April 2020 to March 2022, top-rated ESG companies delivered 16 percent higher returns than that of Nifty. The top 50 ESG companies could hold their value after the market crashed in 2020.” – writes our Group CEO, Mr. Sankar Chakraborti, in his article titled ‘When firms play the ESG card for greenwashing’, published by the Hindu Businessline.

Feb 15, 2023

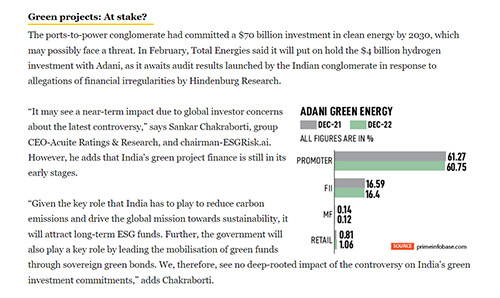

“It may see a near-term impact due to global investor concerns about the latest controversy,” says Sankar Chakraborti, Group CEO-Acuite Ratings & Research, and Chairman – ESGRisk.ai.

Feb 06, 2023

Brickwork Ratings’ shutdown, following Sebi’s wind up order, was unprecedented and it left many in the business fraternity shocked. How have things changed for the rating agencies in India? Have they made their standards stricter? Acuité Ratings Group CEO Sankar Chakraborti spoke to ET Prime giving an overview of the state of affairs in the industry.

Dec 22, 2022

“The value chain partners should be incentivised for adopting these measures, [and] they should also carry a risk to lose out on a potential business opportunity in the absence of these measures,” says Mr. Sankar Chakraborti, Chairman of ESGrisk.ai & Group CEO of Acuité, in the story “India’s elusive net zero target: Reducing Scope 3 emissions by companies may be key”, covered by Business Today.

Nov 22, 2022

While ESG leaders deserve to be lauded, should the perceived ‘ESG disruptors’ be viewed with absolute scepticism? Isn’t it unfair to tag certain industries with a casual term like anti-ESG?

Nov 07, 2022

Average disclosures by newly listed companies on environmental, social and governance (ESG) parameters rose 40% after their initial public offerings (IPOs) and subsequent listing, despite it not being mandatory at the moment.

Oct 06, 2022

One of the most accustomed reporting mechanisms followed in India is the Business Responsibility and Sustainability Report (BRSR). In May 2021, SEBI issued a mandate for the top 1000 companies which are ranked by market capitalisation

July 08, 2022

Companies are spending a lot on the environment to mitigate climate risks. The top performers have scores in the range of 76-92 per cent, according to a study by ESG rating agency ESGRisk.ai

July 01, 2022

Sankar Chakraborti, chairman, ESGRisk.ai, says, “The key issues where PSUs are not performing well are reduction in greenhouse gas emissions and waste management. Setting energy, water, emissions and waste targets for Sustainable Development Goals is a challenge for PSUs .” But he adds, PSUs are adopting net-zero pathways and diversifying their portfolios now.

May 19, 2022

“Sustainability”: The overarching goal of all global, local and commercial organizations since the 2010s seems primarily ambitious in the financial sector. An extensive study assessing NSE 600 companies in FY 2020-21, done recently underscores BFSI as one of the sectors experiencing the highest ESG risks. (study by esgrisk.ai)

May 16, 2022

The integration of new areas like ESG reporting, board and management compensation, initiatives towards waste management, etc have contributed considerably in BRSR becoming more aligned to global frameworks, said Sankar Chakraborti, Chairman, ESG Risk AI and Group CEO, Acuité ratings. India stands at 120 on the world’s Sustainable Development Goals (SDG) index.

According to a study, with the introduction of BRSR, the performance and disclosure standards of India Inc is expected to improve going ahead.

May 15, 2022

In conversation with Sheetal Agarwal of IIFL, Sankar Chakraborti, Chairman ESGrisk.ai & Group CEO Acuité talks about the findings from their deep dive into the ESG practices of Indian PSU companies.

April 25, 2022

Sankar Chakraborti, Chairman, ESGRisk.ai & Group CEO, Acuite, said that “several of the controversies are predominantly with respect to business ethics and stem from violations of insider trading rules, money laundering and non-compliance with SEBI LODR guidelines. BSFI sector is at the heart of ESG integration, the industry should set up policies, undertake initiatives and curate training programs apart from just following the regulations”.

IANS Live | Investing | New Room Odisha | Prokerala | Social News | CanIndia | SME Times | Weekly Voice | Always First | Andhram | Windows To News | Freshers Live

April 25, 2022

Are PSUs joining race for net zero?

Divestment in public sector undertakings (PSUs) is a conscious decision by the government to generate revenues, maximise value creation, and make theses enterprises more efficient. Its a step towards reform, but investors aren’t moved…

April 19, 2022

Banking and financial services is among the top industries that have experienced the most controversies surrounding environmental, social, and governance (ESG) risks, according to research by ESGRisk.ai.

April 18, 2022

A reduction of 50-100 basis points in comparison to similar tenure vanilla g-secs may be necessary for the government to consider raising funds through this platform, said Mr. Sankar Chakraborti, Chairman, ESGRisk.ai & Group CEO, Acuité.

March 28, 2022

Challenges, strategies and way forward: ESG experts’ advice for banks

Large Indian banks have started incorporating ESG approaches for their operations, and the push for a sustainable economy will come from them, experts said, adding that an investment and lending framework will mitigate risks and leverage on market opportunities.

Mar 07, 2022

Sankar Chakraborti, group chief executive officer of Acuité Rating and Research and Chairman at ESGRisk.ai believes that if comprehensive public disclosures and data are made available, investors will be able to interpret this data effectively, develop benchmarks, and objectively assess performance with the help of ESG ratings.

Feb 16, 2022

Based on ESGRisk.ai’s data of Nifty 500 companies listed data, India has an average of 22 percent female in workplaces in global comparison. India ranks third globally at 39 percent in female diversity in senior management roles as against the global average of 31 percent.

Feb 10, 2022

It is easy for Scandinavian or Norwegian companies to say they will not use coal given their demographics, but it’s difficult to practice such a position in India, if not impossible,” Sankar Chakraborti, group CEO at Acuite Ratings and Research and chairman at ESG rating provider ESGRisk.ai said in an interview.

Feb 10, 2022

“It is easy for Scandinavian or Norwegian companies to say they will not use coal given their demographics, but it’s difficult to practice such a position in India, if not impossible,” Sankar Chakraborti, group CEO at Acuite Ratings and Research and chairman at ESG rating provider ESGRisk.ai said in an interview.

Jan 25, 2022

“It is easy for Scandinavian or Norwegian companies to say they will not use coal given their demographics, but it’s difficult to practice such a position in India, if not impossible,” Sankar Chakraborti, group CEO at Acuite Ratings and Research and chairman at ESG rating provider ESGRisk.ai said in an interview.

Jan 24, 2022

The Securities and Exchange Board of India (Sebi) has started work on having standardized norms for companies on the environment, social and governance factors, a move to guide investors take better investment decisions.

Jan 22, 2022

The ESG leader in Data Privacy & Security Vakrangee Limited has crosses the mark of Rs. 12,550.85. The company has announced a 74.58 per cent year-on-year rise in the consolidated profit at 29.33 crore for the quarter ended December 31, 2021, due to process automation & technology initiatives.

Jan 07, 2022

Mr. Sankar Chakraborti de-myths the ESG rating in details and highliights on how ESG rating is not a tool for activism or marketing.

Nov 22, 2021

Several PSUs are taking steps to shift their business portfolios towards long-term sustainability, said by Nasrin Sultana. India’s state-run companies continue to lag behind their private peers in environmental, social and governance (ESG) scores, a key criterion for fund allocation by global investors.

Nov 16, 2021

As the globe battles climate change and its adverse effect on the sustainability of life and business on the planet, investors and lenders now also want to know a company’s performance on environmental, social and governance (ESG) factors besides financial ratings. Last year Acuite Ratings & Research launched ESGRisk.ai to provide ESG ratings to India’s top listed companies.

Sankar Chakraborti chairman, ESGRisk.ai & group CEO, Acuité Ratings & Research tells Krishna Kant from Business Standard why ESG scores matter to investors.

Nov 04, 2021

Mr. Sankar Chakraborti writes about how ESG-Risk management and brand identity are closely interlinked, highlights on case study like Foxconn & Satyam.

Oct 13, 2021

“ESG does not remain in books anymore but is a reality now with global investors offering incentives to complaint borrowers”, said Sankar Chakraborti, CEO at Acuite ESG Ratings and he continued “Indian companies have woken up to the reality, particularly during the pandemic period. ESG rewards investors and the theme will gain more traction.”

Oct 07, 2021

ESG Risk AI has recognized efforts on Vakrangee’s Data Privacy & Security, they leads the category among 500 listed companies. Vakrangee has a robust Data security program which has been designed and implemented, throughout the organization

Oct 07, 2021

Speaking at the ESG India Leadership Award,SBI Chairman Mr. Dinesh Khara said, “Unless banks are able to provide adequate credit to green projects and measure risk in their portfolio, the bank’s depositors and shareholders will continue to carry ESG (environmental, social and governance) risk that can erode returns.”

Oct 07, 2021

The ESG rating agency reviewed top 500 listed companies across 55 industries. Among 500 listed companies Infosys has best environmental social and governance (ESG) practises while Axis Bank has better transparency in disclosures and reporting standards among Indian companies. Click to read more about the snipet

Oct 07, 2021

“A formal definition of green finance in India would enable more precise tracking of finance flows to the green sectors, which in turn would help design effective policy regulations and institutional mechanisms directed towards increasing both public and private investment in green sectors” Mr. Dinesh Khara, SBI Chairman said.

Oct 07, 2021

“India is taking its rightful place on the world stage and as a global leader, we have to lead not only on growth indicators but also sustainability indicators,” said Dinesh Khara, the chairman at State Bank of India. while speaking at ESG India Leadership Awards presented by esgrisk.ai.

Sept 08, 2021

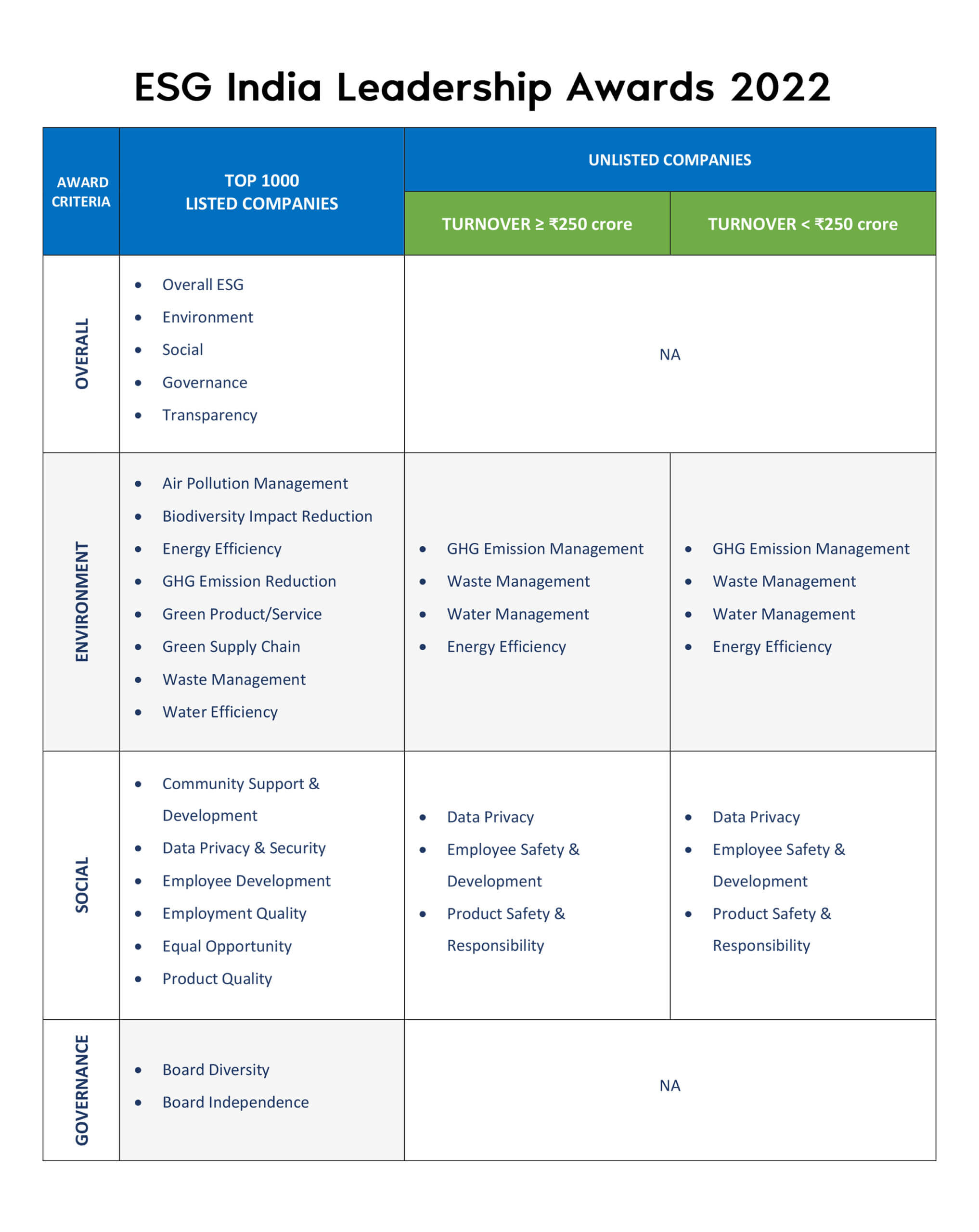

ESGRisk.ai, India’s first ESG rating agency, is pleased to announce the first edition of ‘ESG India Leadership Awards’.

The awards aim to recognise sustainable Indian companies and celebrate their achievements in ESG.

Sept 08, 2021

ESGRisk.ai, India’s first ESG rating agency and an Acuite goup company , has felicitated companies that have achieved excellence in the sustainability space.

ESG India Leadership Awards ‘ ceremony, was held virtually today after months of meticulous screening processes to select the winners from India’s top 500 listed companies across 55 industries.

August 30, 2021

Environment, Social and Governance Rating: ESGRisk.ai aims to expand coverage by 500 more listed cos before fiscal end

ESGRisk.ai, the country’s first ESG Rating company, plans to bring by March 2022 another 500 listed companies under its rating universe for Environment, Social and Governance (ESG) assessment, Sankar Chakraborti, CEO, Acuite Group, has said.

Its ESG Rating service, which was launched in June this year, already covers top 500 listed companies, Chakraborti told BusinessLine. Going forward, next fiscal the company will look to do ESG rating of 2,000 overseas companies and thereby become a global service provider.

July, 2021

Looking for the Best ESG Rating Method? Good luck with that.

The spurt in data providers for such ratings stems from the fact that funding for companies is being increasingly tied to explicit ESG goals. Over $40 trillion has been pumped in globally in ESG-focused investments, according to ESG Risk Assessments & Insights Ltd. in India.

July 2021

Interview of Mr. Sankar Chakraborti, Chairman, ESGRisk.ai published in ‘Dun & Bradstreet – India’s Top 500 companies 2021’

Mr. Sankar Chakraborti, Chairman- ESGRisk.ai and CEO- Acuité Group shares his views in an exclusive interview published in ‘Dun & Bradstreet – India’s Top 500 Companies 2021’. He speaks on how better ESG compliance can affect India Inc. positively in the long run, the use of technology to drive ESG, the status of ESG compliance in India, and ESGRisk.ai’s assessment and rating services.

13 June 2021

Disclosure norms for ESG funds, a step forward

12 June 2021

Acuité Group launches firm to provide ESG Ratings

Acuité Group has launched ESG Risk Assessments & Insights in order to assess a company’s ESG performance and assign a rating. ESGRisk.ai will provide ESG ratings of the top 1000 Indian listed companies, by evaluating their performance on Environment, Social and Governance parameters as well as their reporting transparency. Its assessment approach includes identification of relevant risks, estimation of materiality and polarity of the risks, and evaluation of risk management framework.

3 June 2021

Interview of Sankar Chakraborty, Chairman, ESGRisk.ai | IIFL

Sankar Chakraborti, Chairman of ESGRisk.ai and CEO Acuité Group share his views in an exclusive interview with IIFL. In this interview, he speaks on the need for standardization and development of models in ESG Rating, implications of BRSR guidelines on the corporate sector and ESGRisk.ai’s rating model.

26 May 2021

ESGRisk.ai unveils ESG Rating Methodology

ESGRisk.ai – an Acuité Group Company, has unveiled its ESG rating methodology and made it available to all stakeholders creating transparency in the ESG assessment process. The methodology will enable the key stakeholders including corporates, asset owners, asset managers, retail investors and banks to understand the evaluation and scoring process of ESG risk.

14 May 2021

ESG funds: The irresistible combination of ‘do good’ and ‘do well’

Mr. S S Mundra, Non-executive Chairman of Acuité Ratings & Research Limited and Former Deputy Governor of RBI writes in today’s Mint on how ESG investment is becoming mainstream for investors and businesses

13 Apr 2021

Acuité Ratings is setting up a dedicated rating company for ESG (Environment, Social and Governance) opportunities. Christened as ESGRisk.ai it is supposed to be India’s first ESG rating company. It will cover a company’s ESG performance across three categories, 25 themes and 38 key issues.

12 Jan 2021

Acuité Group has launched ESG Risk Assessments & Insights in order to assess a company’s ESG performance and assign a rating. ESGRisk.ai will provide ESG ratings of the top 1000 Indian listed companies, by evaluating their performance on ESG parameters as well as their reporting transparency. Its assessment approach includes identification of relevant risks, estimation of materiality and polarity of the risks, and evaluation of risk management framework.

28 Nov 2020